My morning reads:

• Know Your Major Asset Classes (The Capital Spectator)

• On cash hoarding (FT Alphaville)

• Where to Join the “Great Rotation” Into Stocks (Barron’s)

• More College Grads Equals Faster Economic Growth (Bloomberg) see also In Shovels, a Remedy for Jobs and Growth (NYT)

• Clients trust advisers; advisory firms, not so much (InvestmentNews)

• I’m sure this will work out fine: Big Banks Are Told to Review Their Own Foreclosures (DealBook)

• Apple’s Tim Cook: Retail Philosophy, Acquisitions, and the Apple Ecosystem (MacRumors) see also Is Apple Really Developing Wristwatch Computer? (Bloomberg)

• How the Horsemeat Sneaked Into the Lasagna (Businessweek)

• Rock Stars: Then and Now (NBC Bay Area)

• Yesterday was Darwin Day 2013 (Slate)

What are you reading?

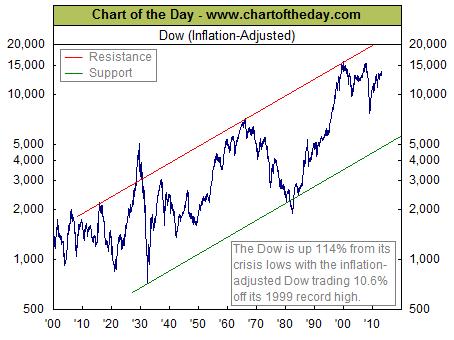

Chart of the Day

Source: Chart of the Day

What's been said:

Discussions found on the web: