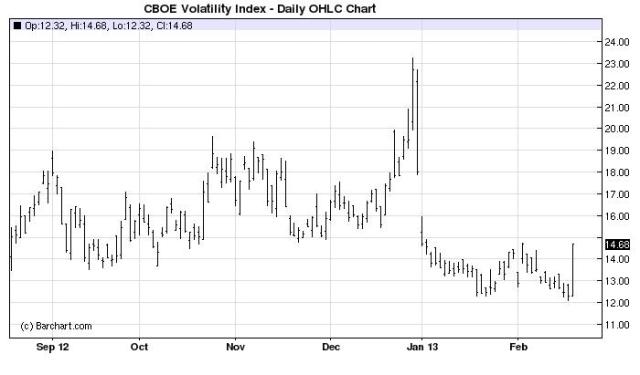

The S&P500 had its worst daily decline for the year. The VIX spiked over 19 percent, its biggest 1-day increase in 2013. The dollar index closed at its highest level since November 16th, which was the day the S&P500 bottomed and began its relentless 14 percent move to yesterday’s high of 1530. Gold got clocked with its 50-day moving average falling through the 200-day generating the feared “death cross.”

It’s now or never for that long anticipated equity correction.

We do see a few catalysts that may bring out some sellers — and there must be some real sellers to generate a decent correction. A dearth of sellers has been a major reason for the recent melt up, in our opinion.

Selling catalysts:

1) China tightening to cool real estate speculation. See here;

2) Housing stocks, the leaders in the latest move, are rolling over. See here.

3) Sequestration and fears of fiscal drag on demand and economic growth. See here.

4) Fed heads getting nervous over super loose monetary policy. See here and here.

5) The hit to consumption due to the rise in gas prices. See here.

6) Equities have been generally overbought. See here.

We expect the correction to be relatively shallow, less than 5 percent, as many buyers seem to be waiting in the wings ready to pounce. You never know how psychology will change with negative price action, however. As prices move lower fundamentalists tend to retrofit their views to the price action.

Don’t blink. Stay tuned.

(click here if charts are not observable)

What's been said:

Discussions found on the web: