My wife happened to mention hearing a financial guru on the radio a little while back. I am always interested in knowing what financial gurus are saying (and thinking maybe it was Ritholtz or Rosenberg or Levkovich or someone else I personally know). I asked her who it was.

“Dave Ramsey,” she said.

“Dave who?” was my reply.

So I asked around – colleagues, friends in the business, etc. etc. Couldn’t get a bid. I turned to The Google and in short order realized that Dave Ramsey is the male version of Suze Orman. He seems to be a self-promoter with little actual experience or knowledge of financial markets or economics. But what really struck me was the condescending, patronizing tone he directs toward his callers. This a site refers to him as a “Christian financial guru,” yet he doesn’t seem to preach in very Christ-like manner.

I could write a thesis about all that’s wrong with this ilk. But rather than take the 30,000 feet view (that’s BR’s province), let’s get granular:

Once again, investors are reacting to the uncertainty in the stock market by investing in gold. Since the third quarter of 2010, the price of gold has jumped 40%, peaking at just over $1,900 an ounce. The “experts” are touting gold as the only “safe” investment in a volatile market.

So is now the time to buy gold?

No way!

Think about it: Why would you buy something at its all-time high?

Before we move on to the idiocy of the final sentence, let’s consider another aspect of what’s going on here.

Later in that same post:

Gold Stash is a quality company that will gladly buy any of your unused gold and silver. They do business the right way, going above and beyond. Dave wouldn’t endorse them if they did any less. With Gold Stash, you can take advantage of the high gold prices in a safe and responsible way.

So, not only is Mr. Ramsey advising against gold under nearly all circumstances, he’s recommending selling it to a company he “endorses,” who coinicentally happens to be an advertiser?

Oct. 13, 2009: “He never has, and he never will [advise buying gold]. Companies like GoldStash.com offer an outlet for you to make some money on your unwanted or unneeded jewelry. Dave will only endorse companies that he trusts, and Gold Stash is reputable, honest and absolutely trustworthy.” Gold price then: About $1,050/oz.).

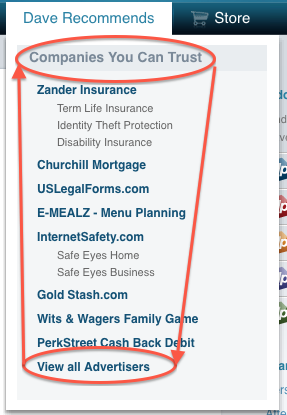

Who is Gold Stash? Hmm. Well, there’s a tab that allows us to see who “Dave Recommends.” There’s Gold Stash. Funny thing is that at the bottom of that drop down is a link for us to “View all Advertisers.”

Gold Stash is an advertiser of his, and Dave wholeheartedly endorses them (and only them, apparently) and, coincidentally, is always – 100 percent of the time – bearish gold. Dave is so concerned about your financial well-being that he’s going to let those suckers at Gold Stash take the hit on your soon-to-be-worthless gold. What a guy.

Then there is the mortgage firm. Out of the thousands of companies that can underwrite or broker a mortgage, Dave recommends just one. Churchill Mortgage. Why is Churchill Mortgage the only mortgage company Dave recommends? What are the financial arrangements here? Same for Zander Insurance. Is there no possibility whatsoever that a competitor of one of these firms could offer a superior product, perhaps at a better price?

It seems that Ramsey doesn’t do much to separate his editorial views from his advertising. Indeed, I am having a hard time finding a line between to the two.

Why is there apparently no disclosure about these conflicts?

If you work under the purview of the SEC or FINRA, you can’t use more than 10 toilet paper squares in the men’s room without getting six levels of compliance approval lest management think you are trying to boost the price of Kimberly Clark (NYSE:KMB). Yet here in guru land, we see potentially audacious conflicts that simply go by without comment. And this information is being disseminated freely to folks who are arguably fairly unsophisticated. WTF?

But let’s get back to Dave’s aversion to “buy[ing] something at its all-time high” comment, which is simply mind-blowing in its sheer stupidity:

• There are hundreds – probably thousands – of stocks about which that could have been (and no doubt was) said over the years that went on to increase exponentially. Apple, anyone?

• Art collectors routinely pay “all-time high” prices for works of art. Happens at just about every major auction. What does Dave know that these stupid collectors don’t? Ditto classic cars. Ditto comic books. Ditto baseball cards. Ditto stamps and coins, and all manner of other collectibles. And on, and on, and on.

• Every major sporting franchise: Baseball, Football, Basketball all sell at continuously higher all-time prices. Professional soccer Manchester United went for nearly $2 billion, and 3 other soccer teams sold for over $1 billion — all record highs.

• What do you think the NY Yankees, Los Angeles Lakers, Dallas Cowboys would sell for today? Higher or lower than their previous sale, which were all time record high prices?

• I paid the then-all-time-high price for my residence 15 years ago. It peaked in 2007, declined when the bubble burst, and has gradually begun to stabilize and recover. At this point it’s probably a bit better than a double.

• There are countless examples wherein buying at the high was exactly the right thing to do. But, bigger picture, I know of no successful investor – not one – who would condone using such a rule. It is antithetical to a sound and prudent investment policy – what about mutual funds Mr. Ramsey “endorses” indirectly via his network of “Endorsed Local Providers” (ELP)? What happens when they’re at all-time highs? (By the way, and very importantly, what are the arrangements between Mr. Ramsey and his ELP’s – and where are those arrangements disclosed?)

Not buying something — anything — solely because it’s at an “all-time high” is, perhaps, the worst investing advice anyone could ever give (or receive) and evidences a total ignorance of investing fundamentals.

Think about BR’s favorite example — the 1966-1082 secular bear market: The Dow hit 1000 in 1966, and didn’t get over it until 1982. Every major index soon after hit their all time highs. If you followed Ramsey’s advice, you would have missed a nearly 1400% move since then.

Additionally, I see Mr. Ramsey was just recently taken to task over his claims that:

-The long term return of the stock market is 12 percent per annum, and

-You’re an idiot if you can’t achieve that 12 percent return

Of course, with the market near all-time highs, continuing to achieve those 12 percent returns – or invest in the market at all – could pose a bit of a conundrum, given Mr. Ramsey’s staunch opposition to buying anything at its high. In fact, I would not be surprised to see Mr. Ramsey turn bearish on equities — perhaps after he inks a deal with the Prudent Bear fund.

Otherwise, avoiding assets at all time highs means you miss every major secular bull market.

UPDATE: March 14, 2013

Dave Ramsey responds to the blog post here

See also:

Dave Ramsey’s 12% Solution “So why does Mr. Ramsey use such high figures? He did not make himself available to explain.”

What's been said:

Discussions found on the web: