Source: Investment Company Institute

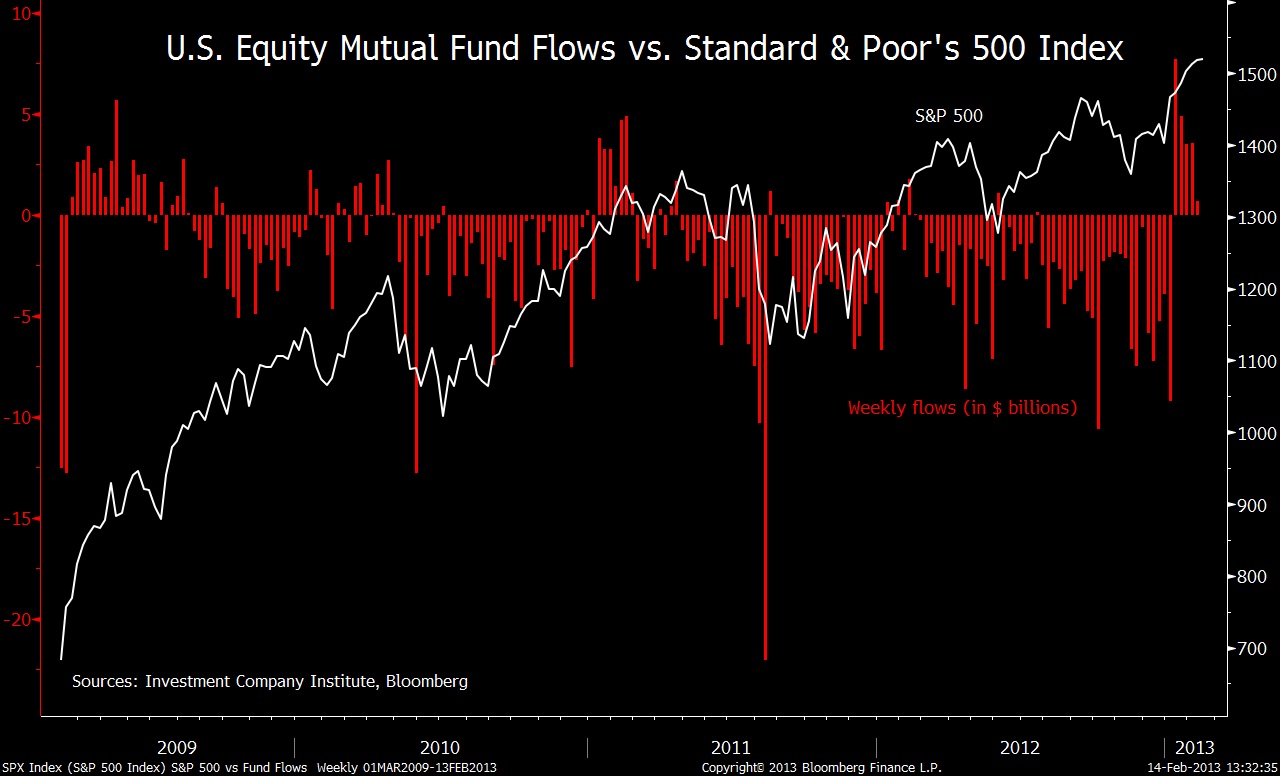

Interesting tidbit for those who are concerned with fundflow: Standard & Poor’s 500 Index more than doubled from the March 2009 lows even though money flowed out of stock funds most of the time. (Data source: Investment Company Institute)

In January, equity funds took in $19.6 billion. This was the largest inflow since ICI started tracking the data six years ago. During the prior 4 year rally, outflows exceeded $435 billion.

Source:

David Wilson

Chart of the Day, February 14, 2013

Bloomberg

What's been said:

Discussions found on the web: