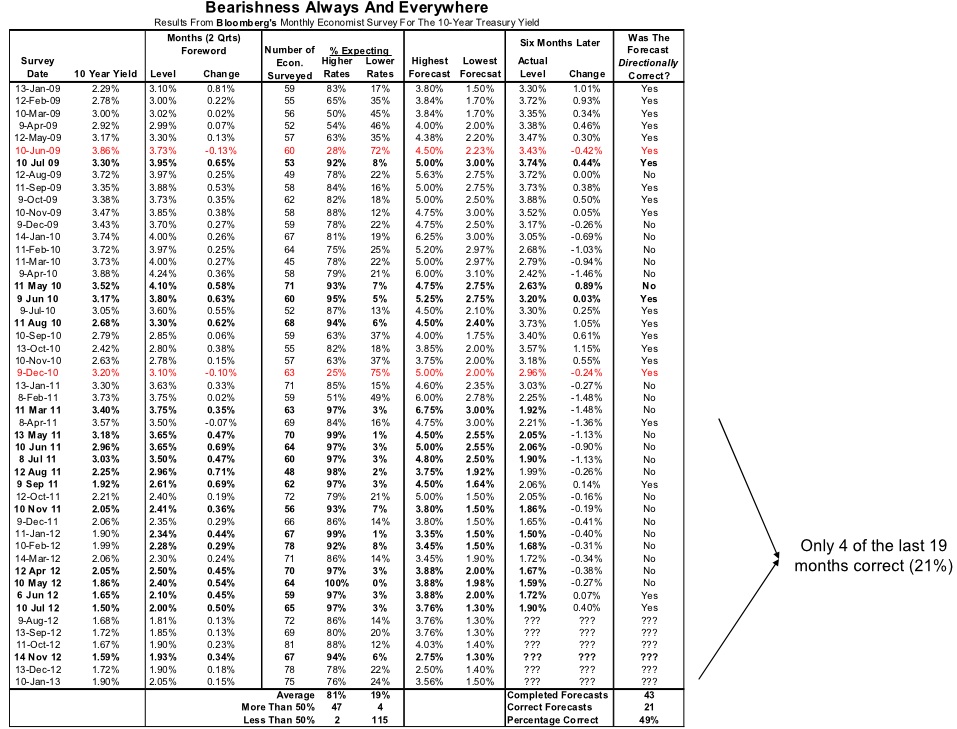

click for larger table

Source: Bianco Research

Fancy yourself a contrarian?

The crowd hates bonds. How about you . . . ?

~~~~

UPDATE February 6, 2013 8:11pm

I am not suggesting backing up the truck with 10 years, I was trying to make a snarky point about crowd opinion. I guess it was too subtle?

What's been said:

Discussions found on the web: