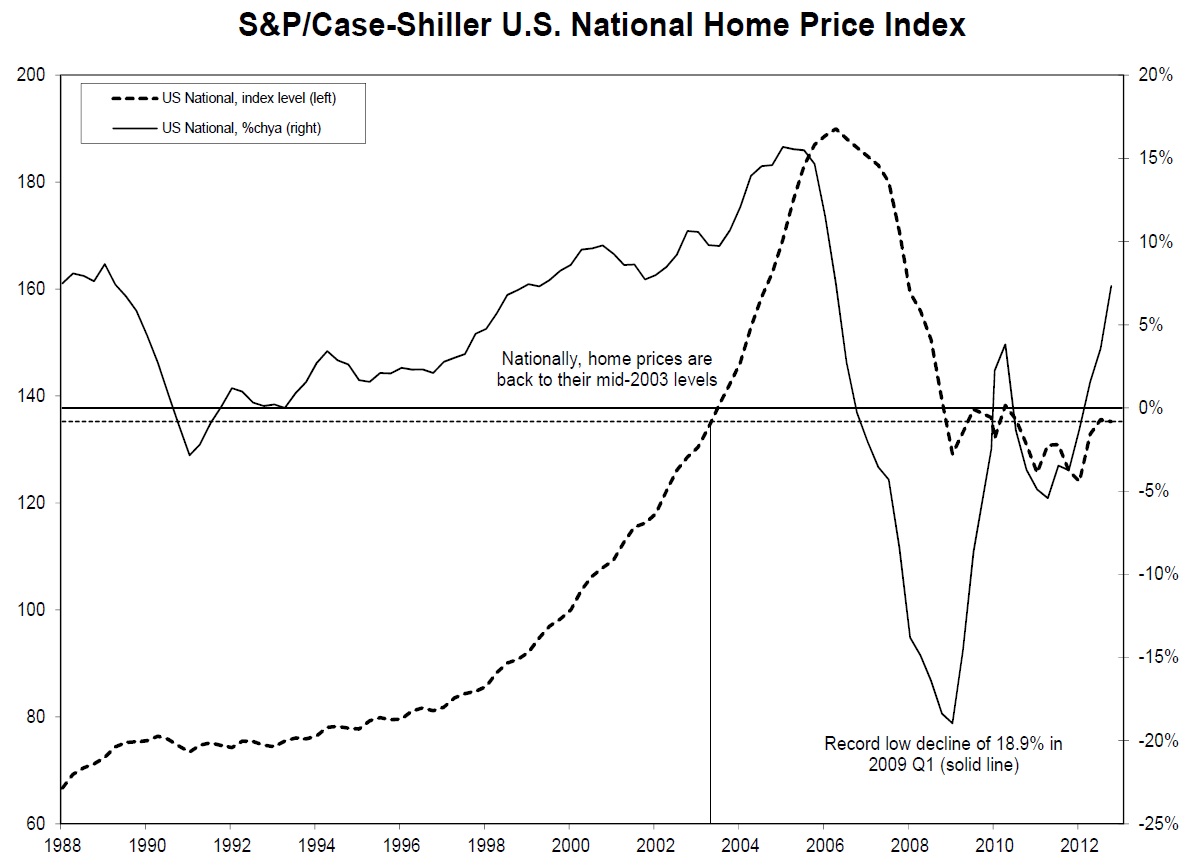

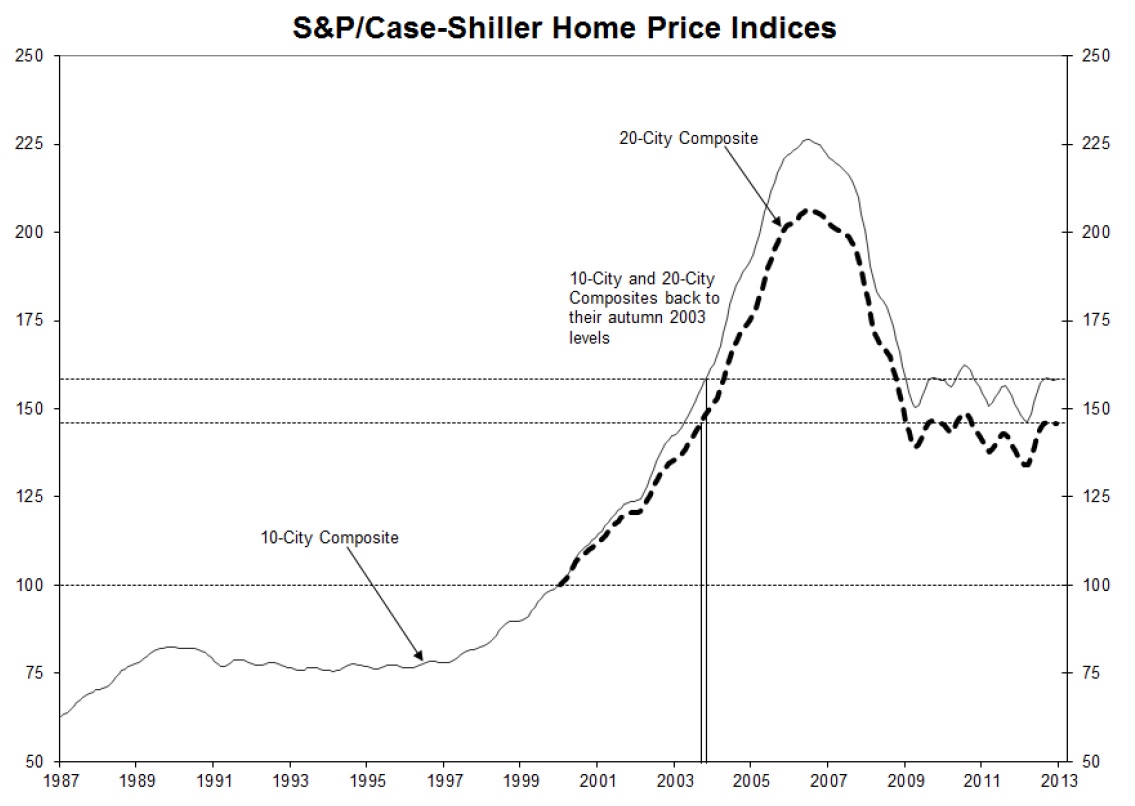

Data through December 2012 for the S&P/Case-Shiller Home Price Indices showed that all three headline composites ended the year with strong gains. The national composite posted an increase of 7.3% for 2012.

Some of the year end transactions were to lock in the low capital gains rates before they changed on January 1, 2013.

The 10- and 20-City Composites reported annual returns of 5.9% and 6.8% in 2012. Nineteen of the 20 MSAs posted positive year-over-year growth – only

New York fell.

Source:

Home Prices Closed Out a Strong 2012 According to the S&P/Case-Shiller Home Price Indices, February 26, 2013

S&P Dow Jones Indices

www.spindices.com.

What's been said:

Discussions found on the web: