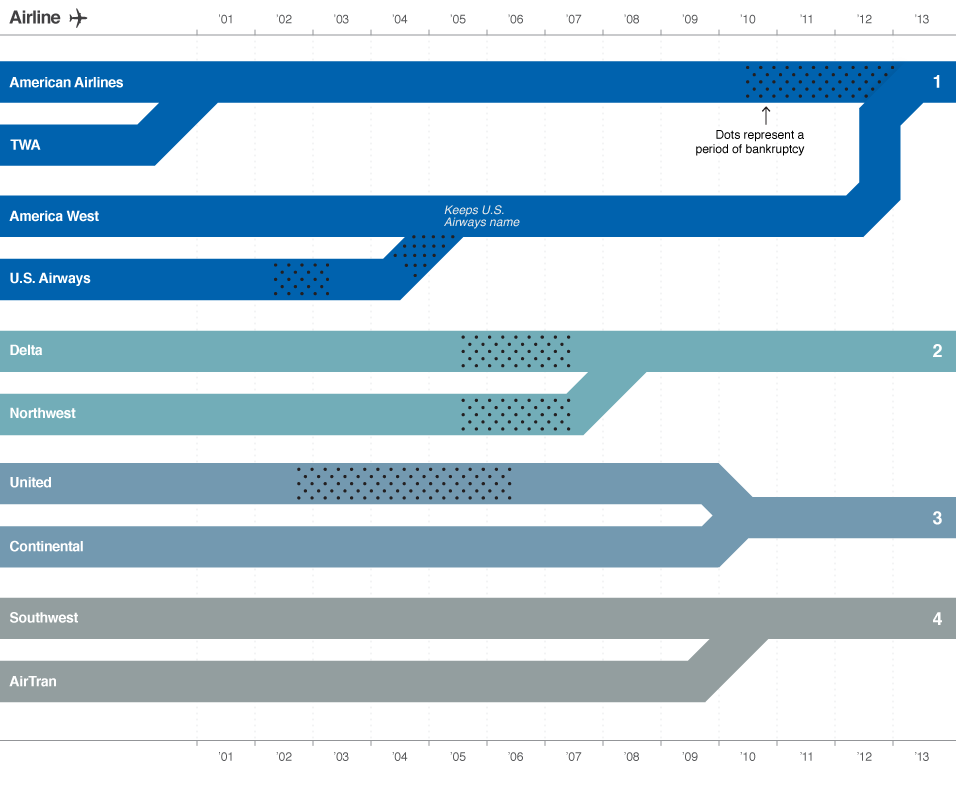

The various bankruptcies and mergers have reduced the major U.S. airlines down to four mega-carriers:

click for ginormous graphic

Source: CNN/Money

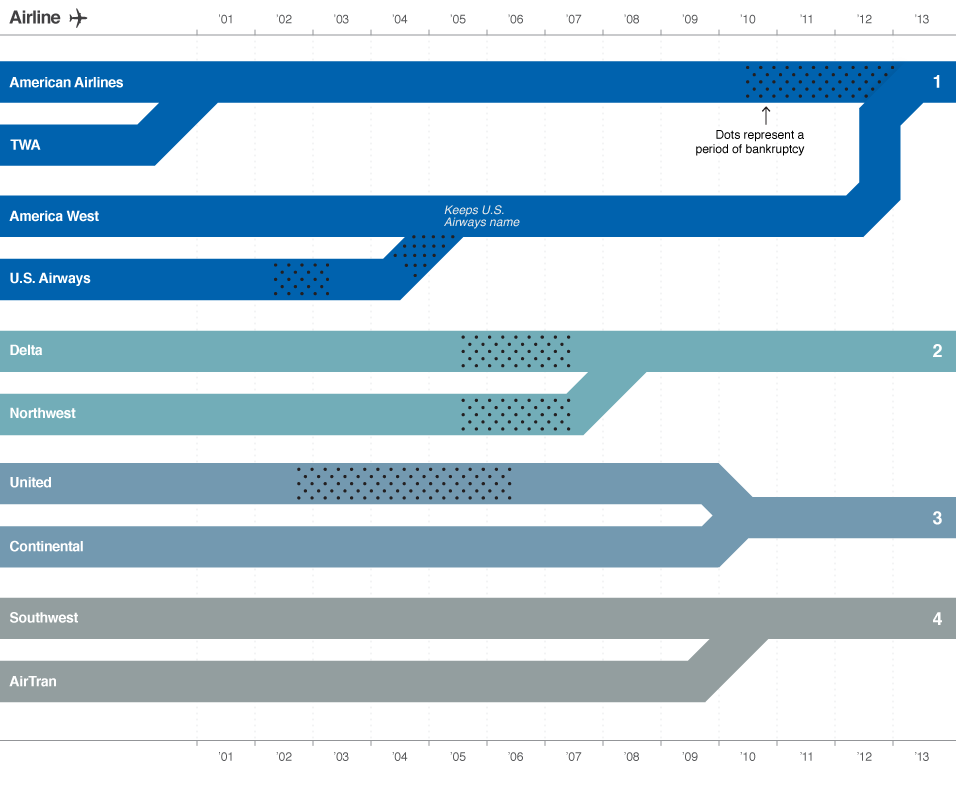

The various bankruptcies and mergers have reduced the major U.S. airlines down to four mega-carriers:

click for ginormous graphic

Source: CNN/Money

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: