click to see larger chart

Source: Bloomberg Briefs

No.

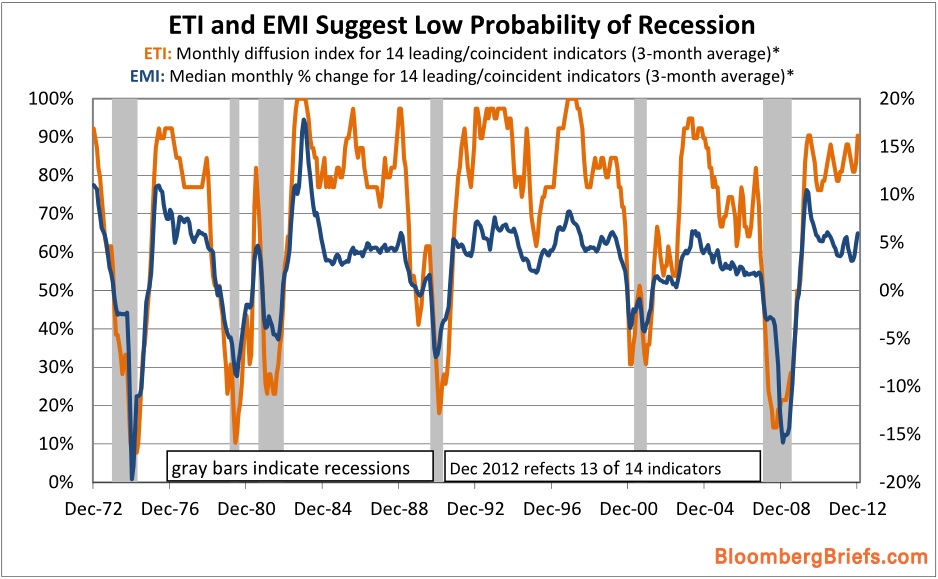

A set of broad economic indices with a good track record say we are not in imminent danger of lapsing into a recession:

“Two economic indexes with impressive records of tracking the business cycle’s major downturns since the early 1970s indicate recession risk is low, based on a broad reading of economic data through December. While January’s profile has yet to be fully determined, the early numbers so far look encouraging.

The economic Trend index (eTi) remains well above the critical 50 percent mark, having risen above 90 percent at 2012’s close. The economic Momentum index (eMi) settled at 6 percent in December, a comfortable margin above the danger zone of zero and below.”

Jim Picerno advocates a statistical approach of analyzing a broad set of financial and economic data. (Think Nate Silver aggregating all of the state and local polls).

As the chart above shows, the economy peaked in December 2007. Many months later, economists and analysts were still debating if another downturn was near. Even in in mid-to-late 2008 the economists as a whole were still in denial about the downturn.

On the other hand, the eTi/eMi aggregate had signaled a contraction as early as April 2008.

Source:

Bloomberg Briefs

James Picerno, CAPITALSPECTATOR.COM

February 11, 2013

www.bloombergbriefs.com

What's been said:

Discussions found on the web: