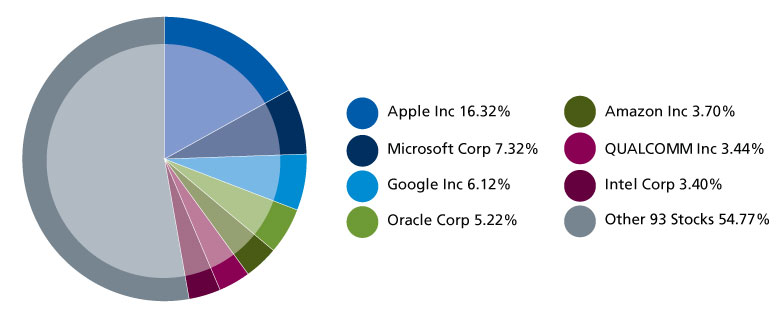

Traditional QQQ Weighting

click for larger graphic

Source: Nasdaq

Long overdue and excellent idea:

Part of the problem with the Nasdaq QQQ’s has bee on the oversize weighting of a few giant market names in it. Certainly Apple (AAPL), but also Microsoft (MSFT), Google (GOOG) and others. Note that chart above dates from 12/31/2012 — after Apple began its slide, and yt still, it was almost 1/6th of the Qs.

The new QQQE is an equal weight set of Nasdaq holdings, each contributing 1% to the overall mix. This reduced Information Technology from 63% to 49%, and raises just about all other sectors in the index.

I’d love to see a chart comparing the cap weighted and equal weighted indices.

UPDATE: February 9 2013 5:39pm

Tom Brakke of The Research Puzzle sends along this chart

What's been said:

Discussions found on the web: