The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price moves. The RSI moves between zero and 100 and is considered overbought with a reading above 70 and oversold when below 30. Note the RSI can sustain an overbought (oversold) reading in a strong up (down) trend.

Overbought and Oversold Markets – February 1

(click here if chart is not observable)

(click here if chart is not observable)

~~~

(click here if charts and table are not observable)

~~~

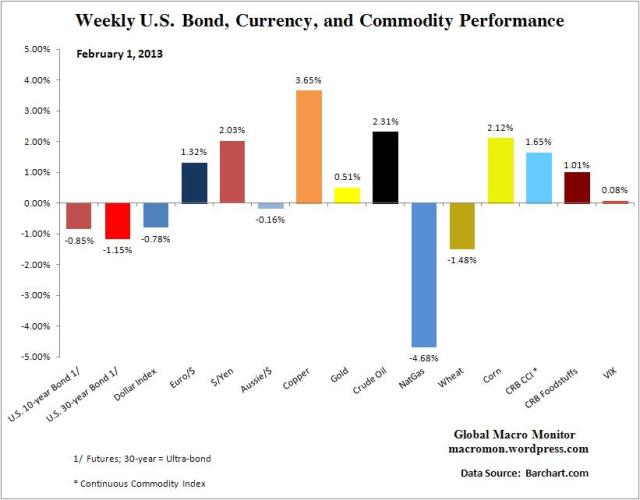

Week in Review

(click here if charts are not observable)