Key Data Points

German 10-year Bund 3 bps higher;

France 1 bps tighter to the Bund;

Belgium 1 bp wider;

Ireland 4 bps tighter;

Italy 17 bps wider;

Spain 2 bps wider;

Portugal 2 bp wider;

Greece 36 bps wider;

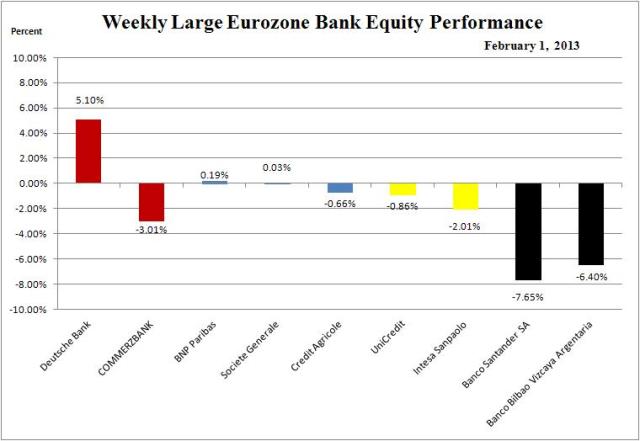

Large Eurozone banks weekly change, -7.0 to 5.0 percent;

Euro$ up 1.50 percent.

Comments

– Eurozone PMI rose to 47.9 from December’s 46.1 – 11-month high;

-The Netherlands nationalised SNS Reaal after a private rescue of the bank and insurance group collapsed;

-France’s manufacturing PMI fell to 42.9 in January, down from 44.6 in December and a 4-month low; –

– Spanish Prime Minister Mariano Rajoy will address the nation on Saturday about corruption allegations.

It’s essential that the next long-term EU budget is devoted to boosting growth, jobs and social cohesion in Europe.

– Mario Monti, Italian Prime Minister

~~~

Global Trend Indicators

~~~

(click here if tables are not observable)

~~~

(click here if charts are not observable)