This week’s European data:

Key Data Points

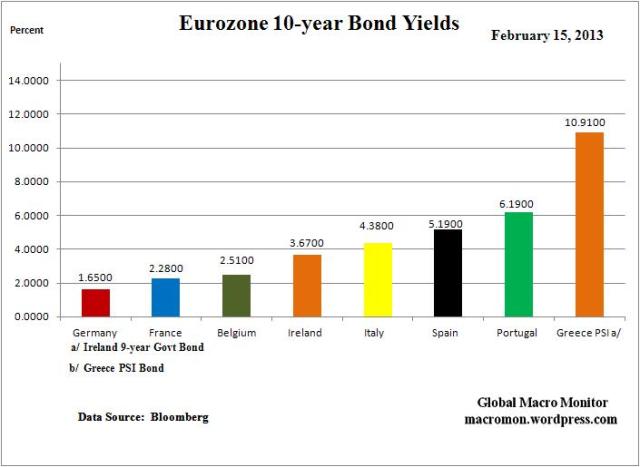

German 10-year Bund 4 bps higher;

France no change in spread to the Bund;

Belgium no change;

Ireland 22 bps tighter;

Italy 21 bps tighter;

Spain 21 bps tighter;

Portugal 40 bps tighter;

Greece 6 bps tighter;

Large Eurozone banks weekly change, -6.13 to 3.16 percent;

Euro$ flat on the week, -0.01 percent.Comments

– Irish sovereign spreads continued to tighten and closed at the lowest level to the German Bund since the beginning of the crisis;

– Cyprus will not impose losses on bank depositors in its banks, the country’s finance minister says;

– Rumors out of Germany that Cypress bailout will cost €16bn;

– Portugal’s debt agency is confident that the country is poised to regain full access to bond market funding in the next few months, FT;

– Bepe Grillo’s Five Star Movement (M5S) is surging in the polls, boosted by the scandal at Italy’s third-biggest bank, Monte dei Paschidi Siena (MPS). If support for M5S increase, it could be in a position to block the formation of majority by either the left or right, which could trigger a new panic.Source: Guardian

**********************************************************

“Currency chatter is inappropriate, fruitless and self-defeating . . . We don’t believe that inflating budget deficits to create demand is sustainable.”

-Mario Draghi, ECB President

(click here if charts are not observable)