Some Good Friday reads for those of you looking for something else to do:

• S&P High Is a Show of Faith in Fed (WSJ)

• Passive investing: If it’s good enough for CalPERS (Investment News) see also Don’t Do It, CalPERS! (Dealbreaker)

• Hoenig: Stop subsidizing Wall Street (Washington Post)

• Simon Johnson: The Debate on Bank Size Is Over (Economix) but see The White House’s dangerous stance on ‘too big to fail’ (Washington Post)

• Profiles of the World’s Best CEOs — Many Paths to Greatness (Barron’s)

• Weil: Betray Your Bank Before Your Bank Betrays You (Bloomberg) see also Controls on Capital Come Late to Cyprus (NYT)

• Long Night at Today (New York Mag)

• China Attack: Apple slammed by China Central TV & Communist Party mouthpiece People’s Daily (WSJ) see also Japan’s Investors Are GungHo for iPhone Game (WSJ)

• Your Client’s Brain: Coping as Your Clients Age (AdvisorOne)

• The Science of Monsters (The Telegraph)

What are you doing today? Market is close, and I have the day off!

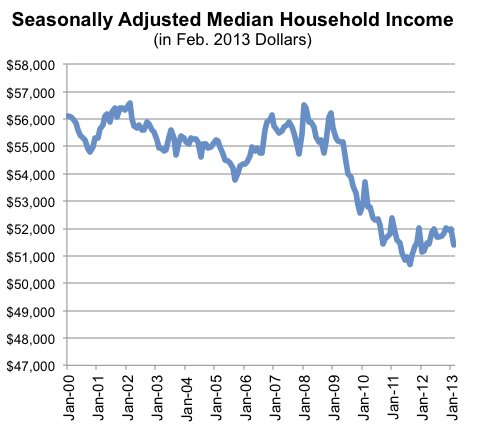

Income Down 7.3% Since Start of Recession

Source: Economix

What's been said:

Discussions found on the web: