My afternoon train reads:

• Cyprus crisis will soon blow over (MarketWatch) but see also Cyprus banks shut until Thursday (FT.com)

• Levin Committee report makes fraud case for JPMorgan shareholders (Thomson Reuters)

• OECD Enables Companies to Avoid $100 Billion in Taxes (Bloomberg)

• Solar Energy is Trapped in a Silicon Valley (Barron’s)

• China hacker’s angst opens a window onto cyber-espionage (Los Angeles)

• Republicans Foil What Majority Wants by Gerrymandering (Bloomberg)

• America’s Latest Phony Fiscal Crisis (Bloomberg) see also The Sequester Is Proof that Washington Thinks We Are All Idiots (The Daily Beast)

• Bringing Them Back to Life (National Geographic)

• Sarah Silverman, Ben Stiller, Michael Cera, And The Rebels Saving Hollywood (Fast Company)

• GOP Issues Scathing Self-Analysis (WSJ) see also Ten ways Republicans say they went wrong in 2012 (Yahoo)

What are you reading?

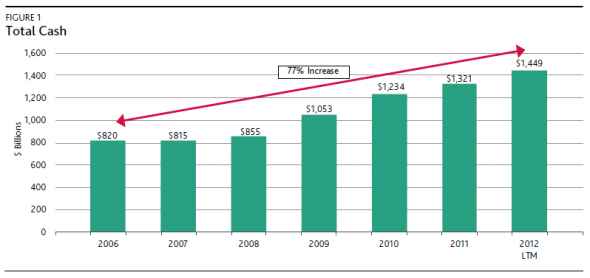

US non-financial cash pile finished 2012 at $1.45 trillion

Source: FT Alphaville

What's been said:

Discussions found on the web: