My morning reads to start your week:

• Retirement Investing vs. ‘Performance Delusion‘ (Forbes)

• Mutual fund investors are often their own worst enemies, prone to poor timing (StarTribune) see also Fund Fees: Slash Them Early (MarketRiders)

• Protecting Power Grids from Hackers Is a Huge Challenge (MIT Technology Review)

• Your Brain Is Hooked on Being Right (Harvard Business Review)

• Berkshire Profit Advances 49% on Buffett’s Derivatives (Businessweek) but see Buffett underperformed the S&P last year (Fortune)

• Sci-fail: Genius Obama says he ‘can’t do a Jedi mind meld’ (Twitchy)

• A Sneaky Way to Deregulate (NYT) see also Promises, Promises at the New York Fed (NYT)

• This Story Stinks: A word about comments (NYT)

• This is why Obama can’t make a deal with Republicans (Wonkblog) see also Four reasons Republicans are embracing the ‘sequester’ (Christian Science Monitor)

• A Few Things You May Not Know About Seth MacFarlane (Neatorama)

What are you reading?

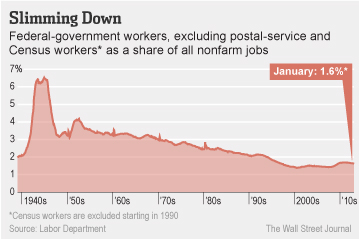

Government Payrolls Shrinking Even Before the Sequester

Source: Real Time Economics

What's been said:

Discussions found on the web: