My morning reads:

• The Market Is Running on Fumes (Barron’s) see also 7 ways to bet against the rally (msn money)

• Dow and S&P 500 Correlation (Bespoke)

• Graham Fisher Sees Parallels to Fannie Mae in JPMorgan (Bloomberg)

• 7 dirty words of trading. (Trader Habits) see also Time (Frame) Management (Random Roger)

• Britain’s austerity is indefensible (FT.com)

• U.S. Tax Cheats Nailed After Swiss Adviser Mails It In (Bloomberg)

• In Rare Move, Apple Goes on the Defensive Against Samsung (WSJ) see also Matt Groening’s Artwork For Apple (VintageZen)

• What Do You Do With the World’s Fastest Internet Service? (Slate)

• New Data Boosts Case for Higgs Boson Find (WSJ)

• Cellphones as a Modern Irritant (NYT)

What are you reading?

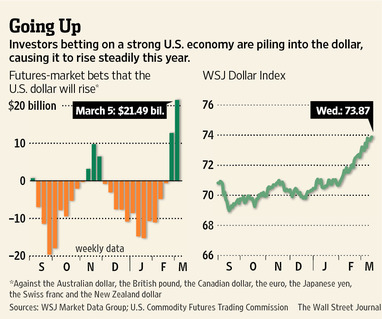

The Almighty Dollar Is Back

Source: WSJ

What's been said:

Discussions found on the web: