My afternoon train reads:

• If you make the same forecast repeatedly for 15 years, you will eventually be right: Dow 36,000 Is Attainable Again (Bloomberg)

• Why analysts should not be investors, Andy Zaky edition (Reuters)

• What to do now if you’re mostly in cash (MarketWatch) but see Wrong question. (The Reformed Broker)

• More to Dow’s Rally Than Just the Fed (WSJ)

• When the Corporate Elite Supported Raising Taxes (Echoes)

• Why 401k Investors Chase Performance – and How to Prevent It (Fiduciary News) see also 401Ks are a disaster (USA Today)

• Investors Seek Ways to Profit From Global Warming (Businessweek)

• To Hell with Reg FD! Bank of America Investors Grill CFO At Dinner (The Street)

• How Disney Bought Lucasfilm—and Its Plans for ‘Star Wars’ (Businessweek)

• A Day in the Life of a Freelance Journalist—2013 (Natethayer)

What are you reading?

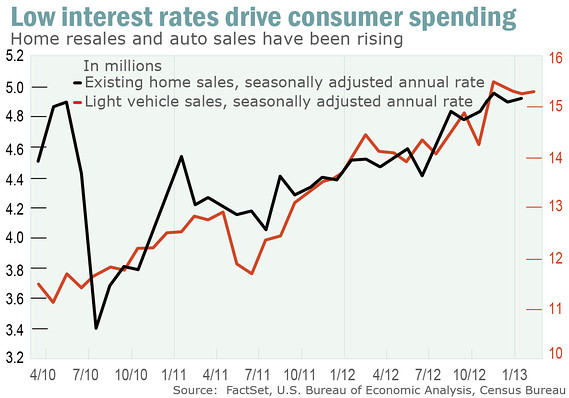

Low Interest Rates Drive Consumer Spending

Source: MarketWatch

What's been said:

Discussions found on the web: