My morning reads:

• Visualizing Bob Farrell’s 10 Investing Rules (streettalklive)

• Gold Sales From Soros Reveal 12-Year Bull Run Decay (Bloomberg)

• Bankrupt 1990s Internet Toy Company Still Thinks It Was Undervalued (Dealbreaker) response to Rigging the I.P.O. Game (NYT)

• The bonus dash beginneth (FT Alphaville)

• Stephen Gandel nails Why Intrade Failed (Fortune)

• Money Advice for People in Boom-or-Bust Fields (NYT)

• The Annotated Guide to Krugman versus Sachs (Economist’s View)

• Do economic fundamentals underpin peak equities? (FT.com) see also Sputtering global economy belies stockmarket boom (The Telegraph)

• Our brains, and how they’re not as simple as we think (The Guardian)

• Can anyone turn streaming music into a real business? (The Verge)

What are you reading?

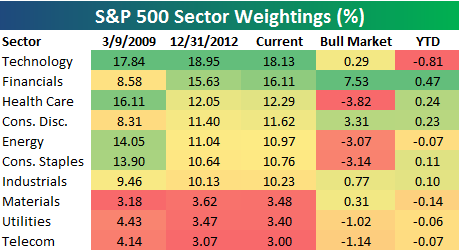

Historical S&P 500 Sector Weightings

Source: Bespoke

What's been said:

Discussions found on the web: