My morning reads to start your workday:

• Size Matters: The Source of the Small-Cap Premium (Above the Market)

• Fed Banker Backs Dialing Down Easy Money (WSJ)

• Cyprus: The Unique Template in Nine Theses (Marc to Market) see also The United States is not Greece, the USA is Cyprus (Guardian)

• BRICS Nations Plan New Bank to Bypass World Bank, IMF (Bloomberg)

• The Management-free Organization (Dilbert)

• McDonald’s Has a Millennial Problem (Advertising Age)

• The 1% aren’t like the rest of us (Los Angeles Times)

• Did the Iraq War Cause the Great Recession? (The Monkey Cage)

• WTF? Makers of TurboTax Fought Free, Simple Tax Filing (ProPublica)

• What You Didn’t Post, Facebook May Still Know (NYT)

What are you reading?

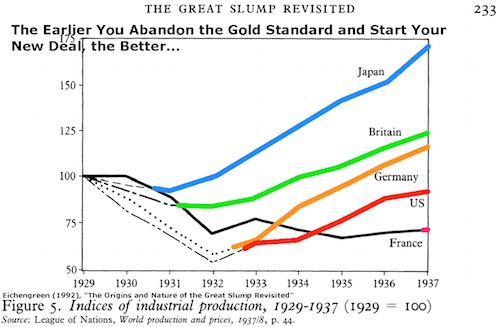

The Earlier Your Economy Abandoned the Gold Standard the Better

Source: Econbrowswer

What's been said:

Discussions found on the web: