My afternoon train reads:

• Political blowback from Cyprus (FT Alphaville)

• A Beginner’s Guide to Irrational Behavior (coursera)

• Perspectives on a Sluggish Recovery (Conversable Economist)

• Carl Levin, The Senate’s Muckraker (NYT) see also Jamie Dimon Told Regulators He Would Not Follow Regulations (FDL)

• Earthquakes and the Mind-Bending Laws of Markets (Bloomberg)

• K is not capital, L is not labor (Interfluidity)

• When Mom and Pops Battled Five and Dimes (Echoes)

• On the Brink? China’s Solar Industry Debt Drama (The Diplomat)

• WTF?! Sequestration Slashes Scholarships for Children of Iraq and Afghanistan War Casualties (ABC)

• For Civilian Drones, the Sky is the Limit (Bits)

What are you reading?

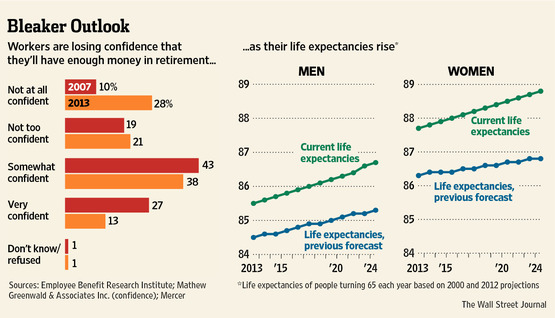

Workers Saving Too Little to Retire

Source: WSJ

What's been said:

Discussions found on the web: