Click to enlarge

Source: Daring Fireball

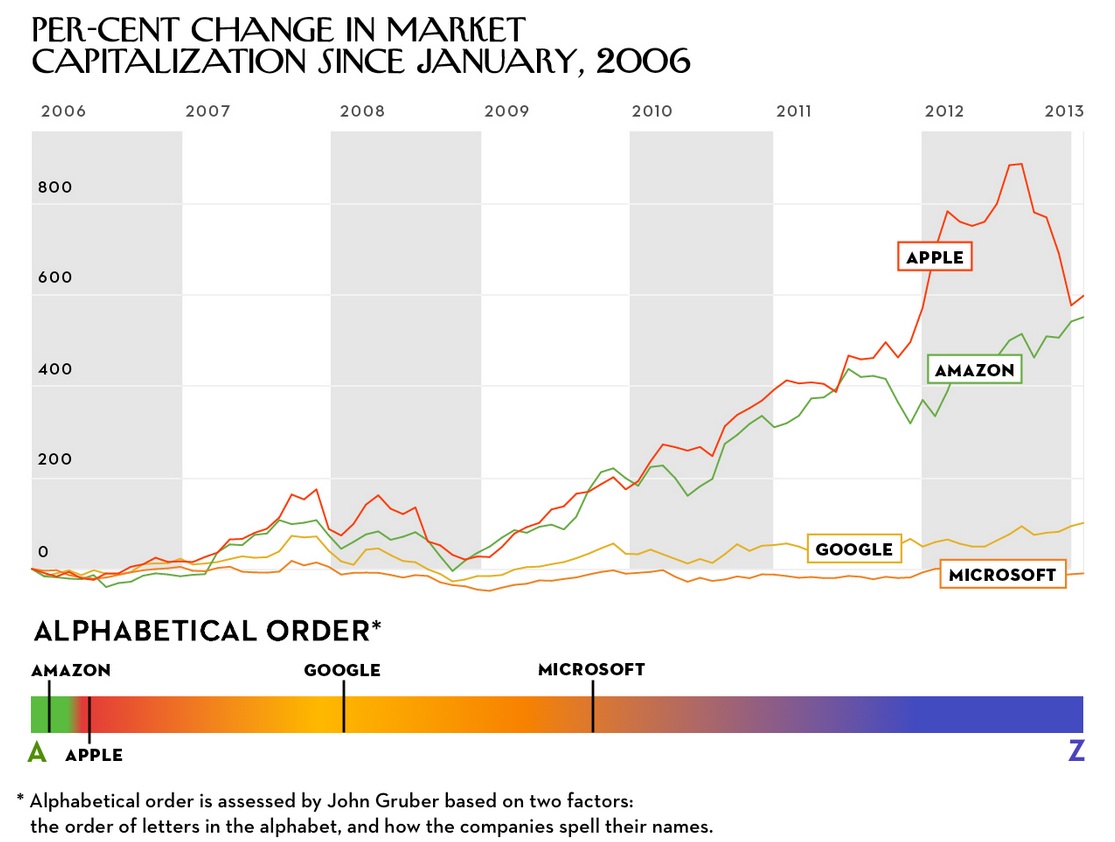

Fascinating chart via John Gruber looking at the relative change in market capitalizations of four of the largest publicly trading tech companies.

The ongoing strength of Amazon is nearly amazing as the continued weakness in Microsoft.

All the while, Google keeps chugging along . . .

What's been said:

Discussions found on the web: