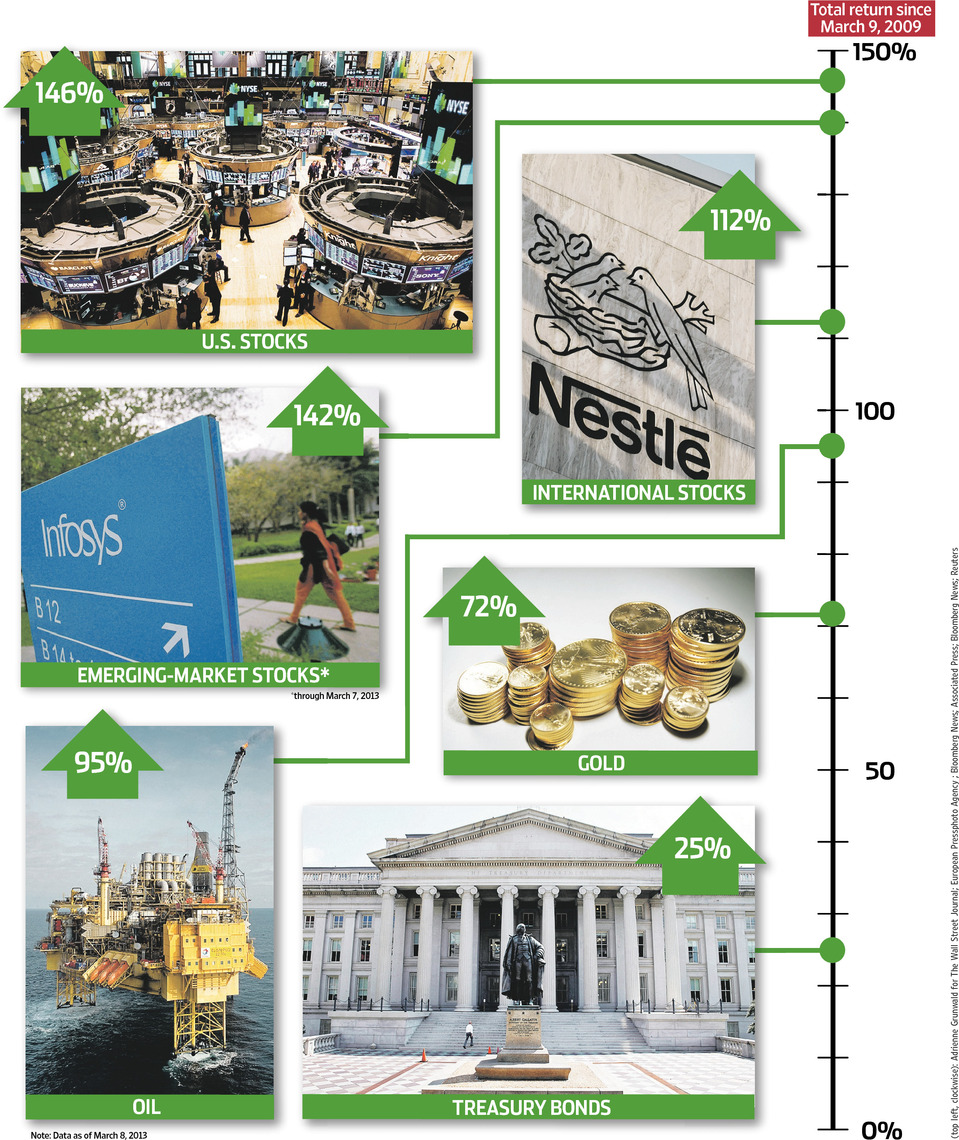

All of the major markets have had a huge run off of the lows (though they are barely flat since the 07 peaks).

What does this mean? Are markets too expensive, or are they better priced than last time?

What say ye?

Source:

Is Anything Cheap?

JASON ZWEIG, JOE LIGHT and LIAM PLEVEN

WSJ, March 8, 2013

http://online.wsj.com/article/SB10001424127887324034804578346610043739152.html

What's been said:

Discussions found on the web: