Source: MillerSamuel

The short answer is 7X the rest of the USA (assuming you have not yet been laid off from that job yet).

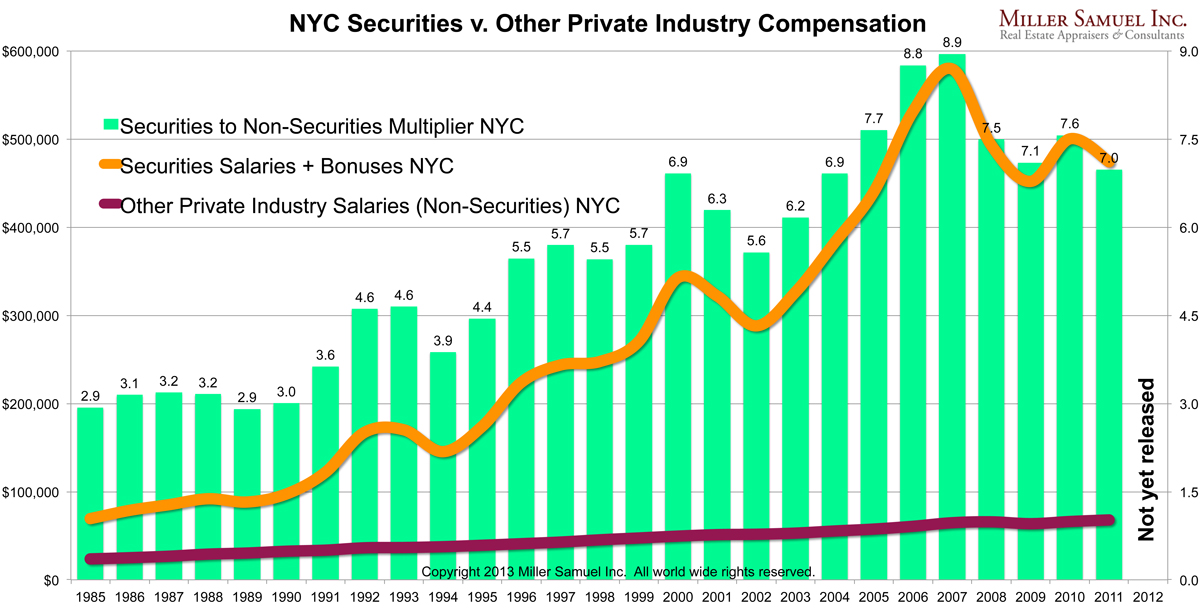

That astonishing data point came to us via Jonathan Miller. He used the state bonus compensation data for 1985-2011.

As of 2011, the securities industry salaries + bonuses were 7x larger than private industry salaries Wall Street remains an important part of the local economy — and this is part of the reason why . . .

Source:

Wall Streeters Paid 7X The Private Sector

Jonathan Miller

Miller Samuel February 27, 2013

http://www.millersamuel.com/blog/wall-streeters-paid-7x-the-private-sector/28511

What's been said:

Discussions found on the web: