>

My Sunday Washington Post column this week looks at two of the major topics of financial news — Politics & Economics.

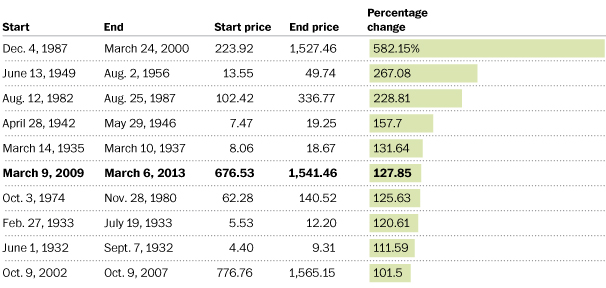

The column draws the counter-intuitive conclusion that these aspects of daily life are mostly meaningless to investors much of the time.

Under the headline Voters should pay attention to politics. Investors should ignore it, it looks at a few historical events that have been much more emotionally resonant than impactful to investments. These include wars, tumultuous presidential events, oh, and silly little non-events like the debt-ceiling debate of 2011 and the sequester of 2013.

Here’s an excerpt from the column:

“Most of the time, economic data is fairly benign. I don’t wish to imply it is meaningless, but it is not a driver of stock markets. Indeed, the correlation between economic noise and how equity markets perform has been wildly overemphasized. To quote Warren Buffett: “If you knew what was going to happen in the economy, you still wouldn’t necessarily know what was going to happen in the stock market.”

The economic cycle sees a constant stream of news. Various data are released on a recurring weekly, monthly and quarterly cycle. Sometimes they improve; sometimes they degrade. These are minor and noisy fluctuations, often reflecting flaws in how the data are collected or seasonally adjusted.

There are many reasons why economic data are so noisy, none of which matter to the primary driver of your investments, namely corporate profits and equity valuations.”

While investors pay too much attention to Politics and Economics, they don’t pay enough attention to valuation and the development of bubbles.

Source:

Voters should pay attention to politics. Investors should ignore it.

Barry Ritholtz

Washington Post, March 8 2013

http://www.washingtonpost.com/business/voters-should-pay-attention-to-politics-investors-should-ignore-it/2013/03/08/e318f940-86a0-11e2-9d71-f0feafdd1394_story.html

What's been said:

Discussions found on the web: