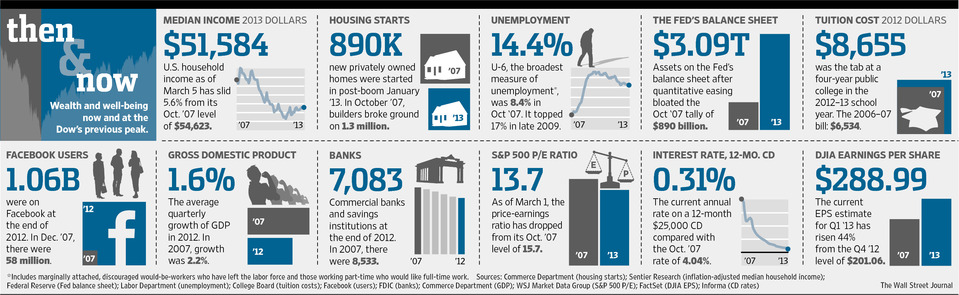

click for larger graphic

Source: WSJ

As Chris White of Dewiler Fenton noted recently (hat tip Art Cashin), lots of things have changed since the last peak in 2007:

Dow Jones Industrial Average: Then 14164.5; Now 14,304

GDP Growth: Then +2.5%; Now +1.6%

Unemployed: Then 6.7 million; Now 13.2 million

Food Stamp users: Then 26.9 million; Now 47.69 million

Fed’s Balance Sheet: Then $0.89 trillion; Now $3.01 trillion

Debt as a Percentage of GDP: Then ~38%; Now 74.2%

Total US Debt: Then $9.008 trillion; Now $16.43 trillion

Consumer Confidence: Then 99.5; Now 69.6

VIX: Then 17.5%; Now 14%

10 Year Treasury Yield: Then 4.64%; Now 1.89%

Gold: Then $748; Now $1583

NYSE Average daily volume: Then 1.3 billion shares; Now 545 million shares

All told, quite astonishing.

What's been said:

Discussions found on the web: