My morning reads:

• Cyprus Deposit Tax Roundup (Macro Exposure) what he said

• Record U.S. Stocks at Lowest Valuation Since 1980 (Bloomberg) but see Options Point to Big Market Move (Barron’s)

• Apple Seen Raising Dividend More Than 50% to $16 Billion (Bloomberg)

• Jeff Gundlach planted his flag on long-term Treasurys a week ago — He’s like an art-collecting warlock. (TRB)

• The War on Common Sense Continues (Tim Duy’s Fed Watch)

• Surowiecki on JCP and others: The Turnaround Trap (The New Yorker)

• Time’s Health Care Opus Is a Hit (NYT)

• Big Bank Brands, Big Consumer Contradictions (The Financial Brand)

• Obama Inc: What businesses want to learn from the president’s campaign (Wonkblog)

• Twitter Just Crushed Wall Street After The Cyprus Bailout (Business Insider)

What are you reading?

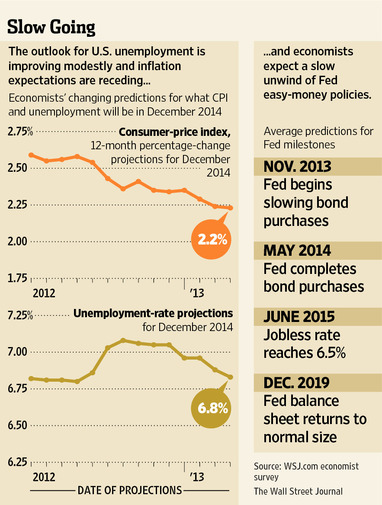

Easy-Money Era a Long Game for Fed

Source: WSJ

What's been said:

Discussions found on the web: