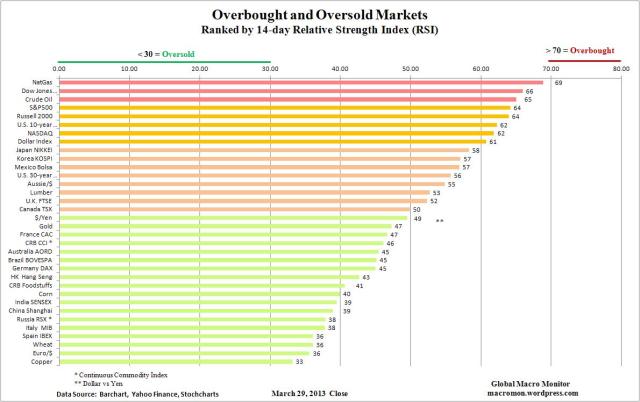

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price moves. The RSI moves between zero and 100 and is considered overbought with a reading above 70 and oversold when below 30. Note the RSI can sustain an overbought (oversold) reading in a strong up (down) trend.

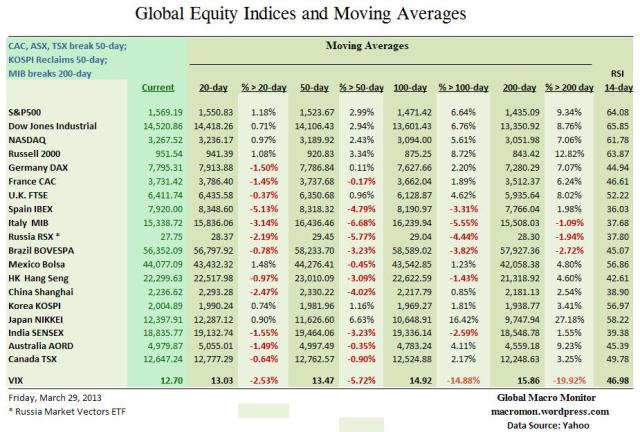

(click here if chart is not observable)

~~~

~~~

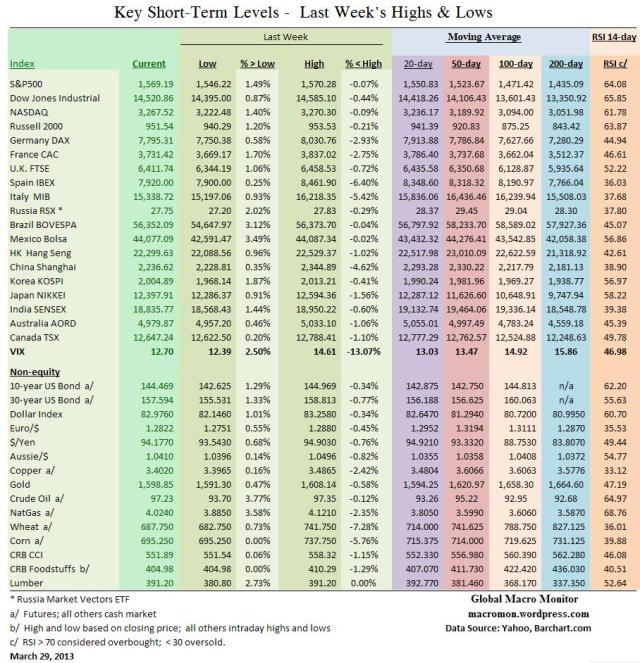

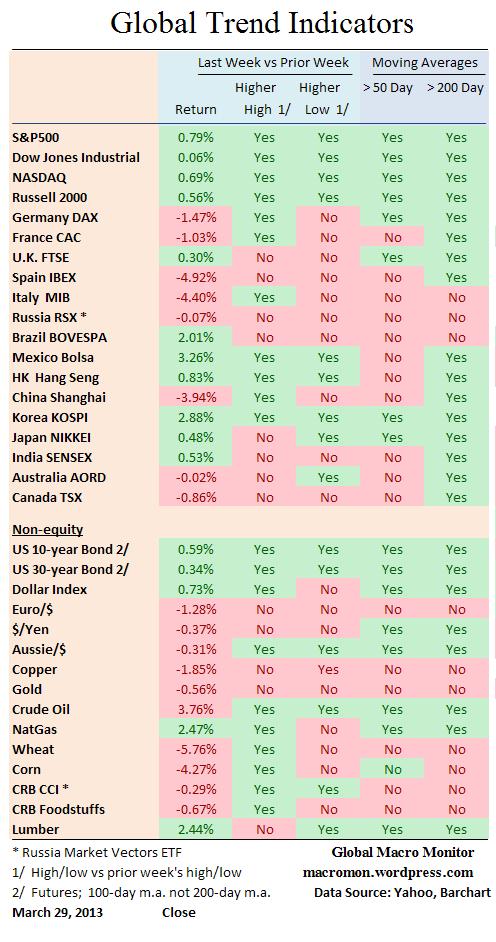

(click here if tables are not observable)

~~~

Week in Review

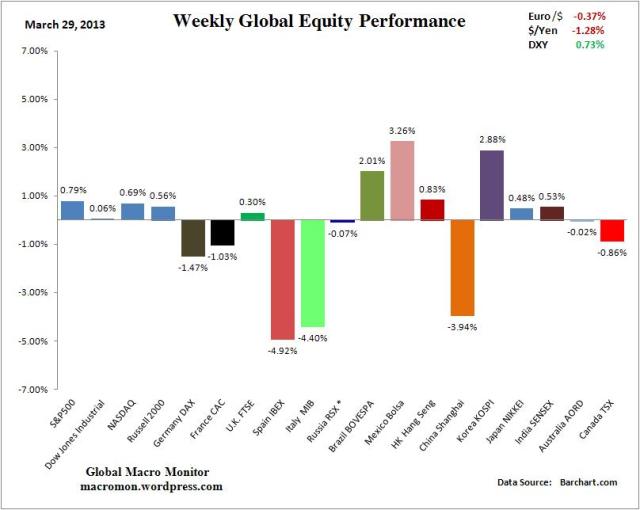

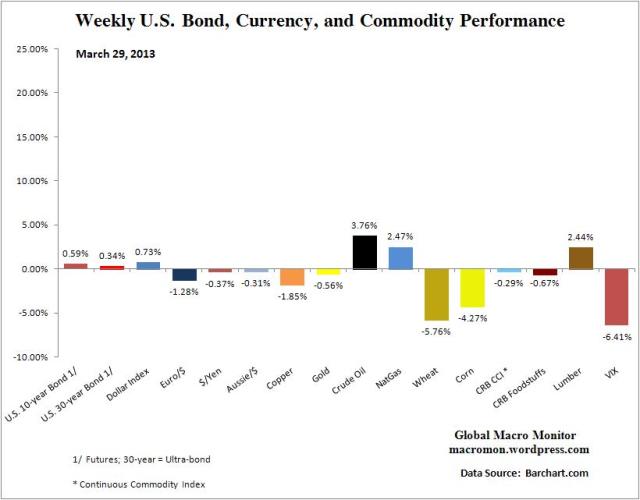

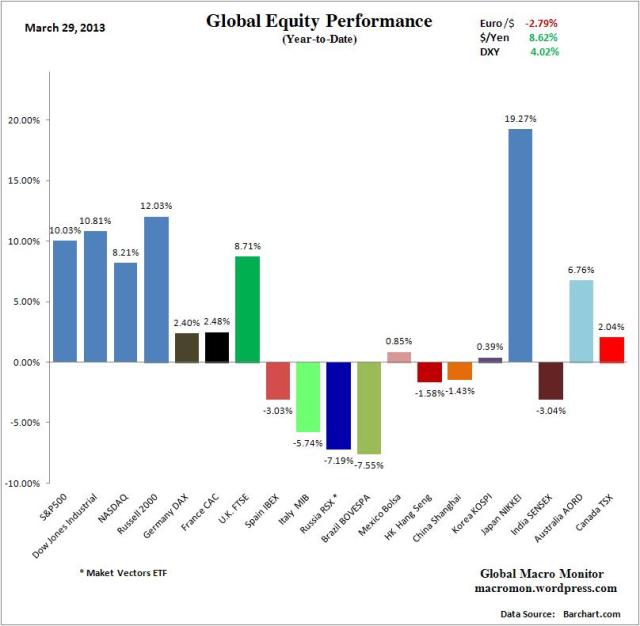

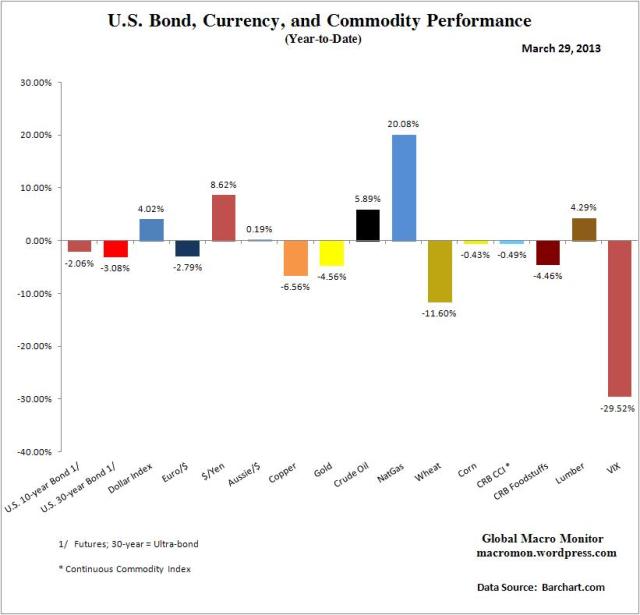

(click here if charts are not observable)

What's been said:

Discussions found on the web: