click for ginormous chart

Source: Fusion Analytics

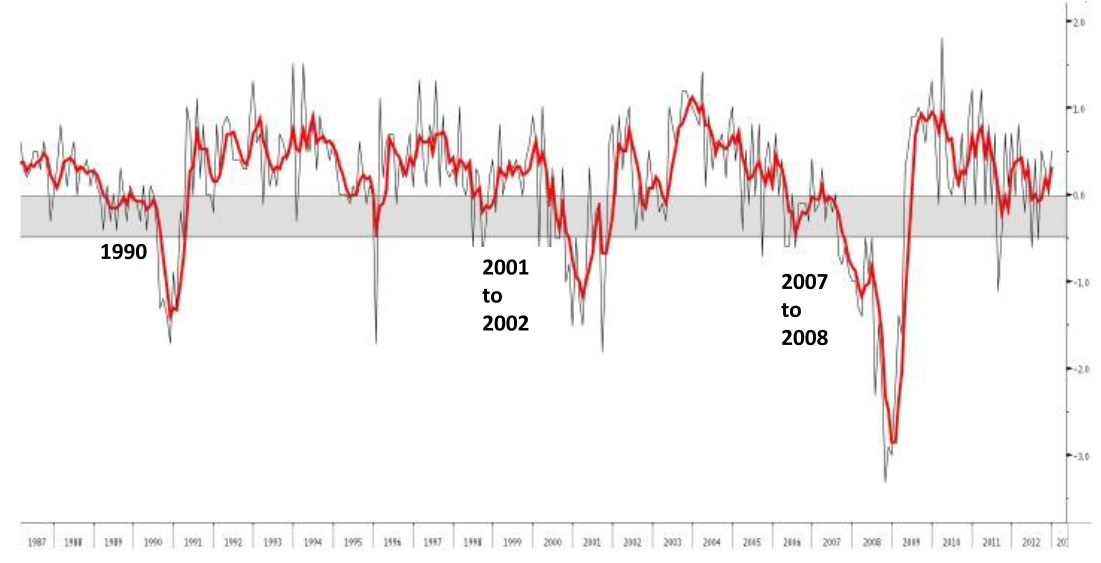

Take a look at the chart above — its the Month/over/month change in the Leading Economic Indicators.

We hold an occasional monthly conference call for FusionIQ subscribers, and this one came up last night.

To avoid whippy or false signals, we use a 4 Month Moving Average of the MoM% change (see red line) watching for a drop below the 0.0 to -0.5% band (gray band). That tends to only occur during pre-recessionary preiods.

The series is not only above the danger zone, but it is trending upwards — meaning that the odds of a recession are minimal.

LEI COMPONENTS:

1. Average weekly hours, manufacturing

2. Average weekly initial jobless claims

3. Manufacturing new orders, consumer goods and materials

4. ISM new orders, consumer

5. Manufacturers’ new orders, nondefense capital

6. Building permits, new private housing

7. Stock prices, 500 common stocks

8. Leading Credit

9. Interest rate

10.Average consumer expectations

What's been said:

Discussions found on the web: