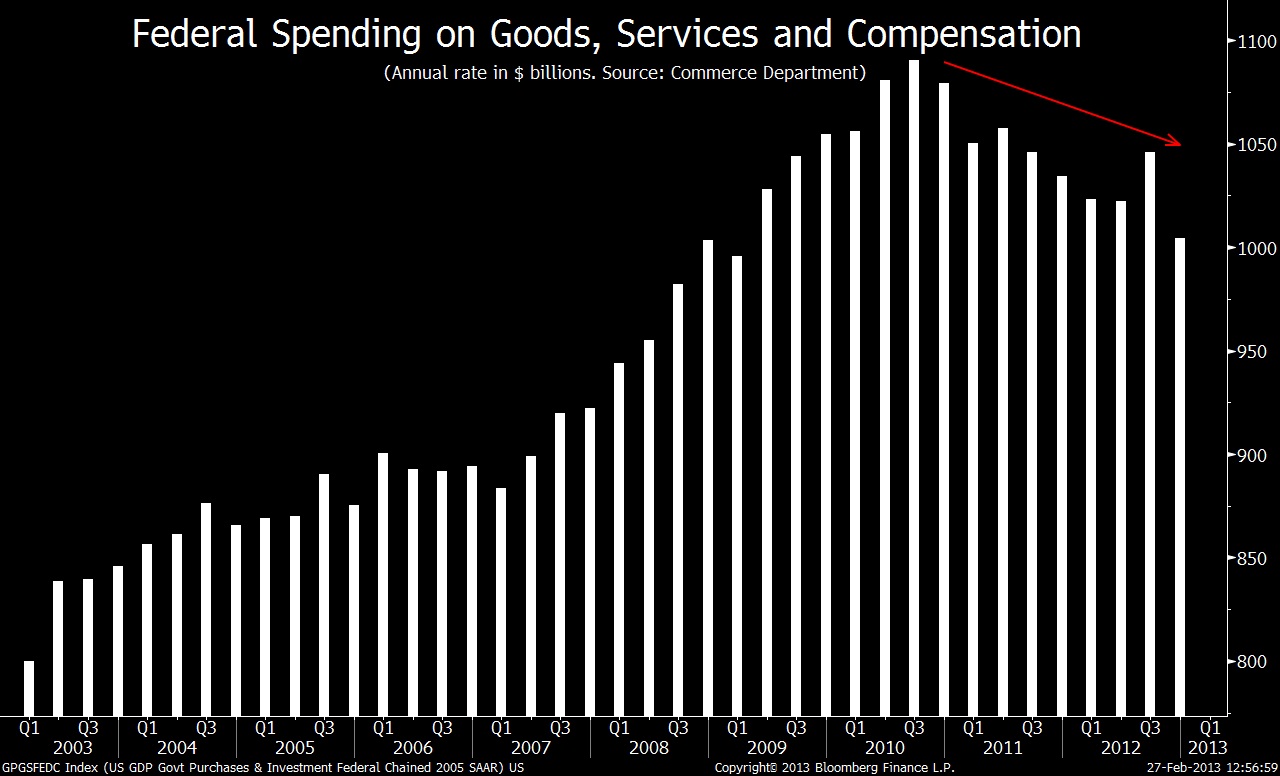

As the chart above shows, federal outlays for goods, services and employee compensation have fallen in seven of the past nine quarters, according to data compiled by the Commerce Department. The inflation-adjusted annual rate fell 7.9 percent from a peak reached in the third quarter of 2010. Spending by state and local governments has also dropped.

The automatic spending cuts that the $85 billion of reductions sequester has imposed is “the same old drag” that the economy has been suffering through for most of the past few years. That is according to a report from Milton Ezrati, of Lord Abbett & Co.

Q4 saw outlays fall 7.2% below Q3 2009.

The possible offset: Spending by state and local governments. After falling during and after the financial crisis, tax revenue is now rising. In 2012, outlays for goods, services and salaries slid 0.9% after dropping a big 2.7% in 2011 and a bigger 3.6% in 2010.

Source:

Spending Cuts Are Nothing New for U.S. Economy

David Wilson

Bloomberg Chart of the Day, February 27, 2013

What's been said:

Discussions found on the web: