Some Sunday morning reading to stimulate your brain pans:

• The Smartest Man in Global Capital Markets on When the Music Will Stop (Minyanville)

• Bad Omens: Mila and the Maestro (Barron’s)

• ‘It’s Becoming Idiotic’ — the Senate’s Riveting Story of the London Whale (Bloomberg) see also JPMorgan’s Follies, for All to See (NYT)

• As stocks rise, so do the number of millionaires (The Washinton Post)

• Steering Clear of Stock Custodian Battles (WSJ)

• China hacker’s angst opens a window onto cyber-espionage (LA Story)

• East India Company: The Original Too-Big-to-Fail Firm (Echoes) see also Why Conservatives Want to Break Up the Banks, Too (New Republic)

• Bruce Schneier: The Internet is a surveillance state (CNN)

• After 15 years, Big Lebowski keeps getting bigger (Toronto Star)

• Jim Gaffigan Is the King of (Clean) Comedy (WSJ)

What’s for brunch ?

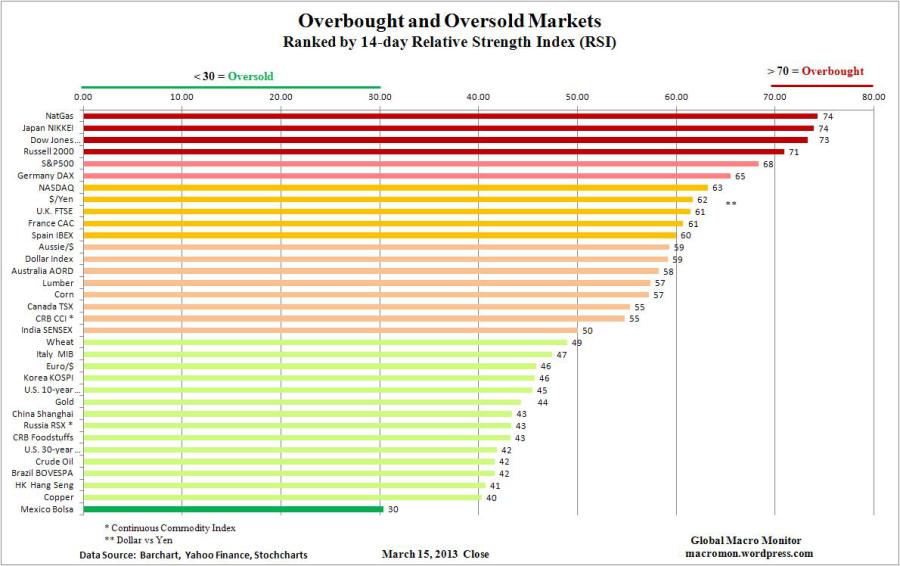

Overbought and Oversold Markets

Source: Macroman

What's been said:

Discussions found on the web: