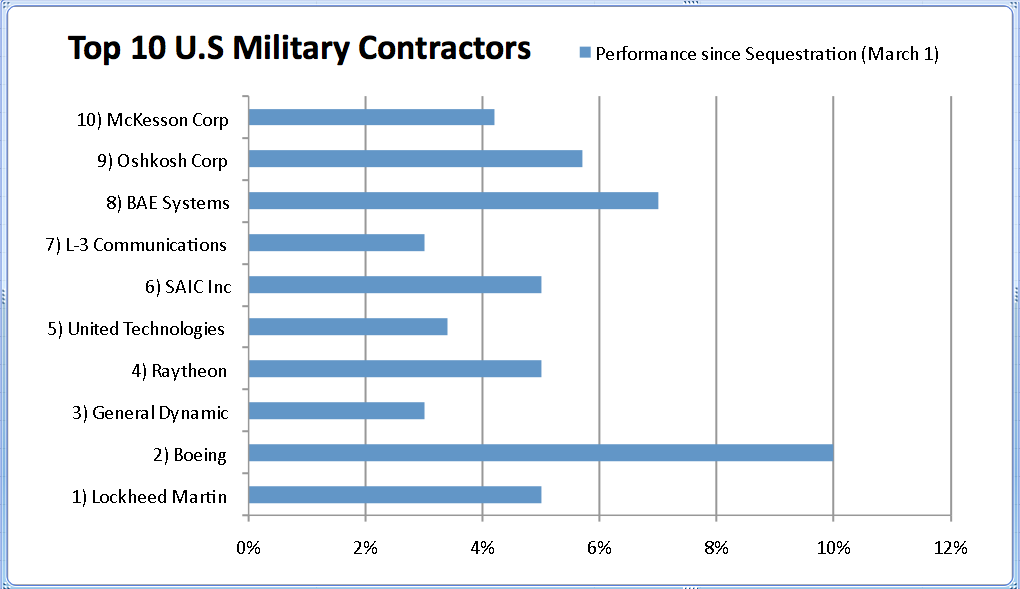

Here’s a little surprise: The top military contractors have all been doing pretty well since Sequestration hit.

I know what you’re thinking: They already got hit in anticipation of Sequestration. Only they didn’t.

Boeing (BA) and Oshkosh OSK are near 52 week highs, while United Technologies (UTX) and McKesson (MCK) 20% are at all time highs. (Table below)

So much for the impact of these government cutbacks on Military contractors . . .

See also:

Chuck Hagel on defense budget cuts under sequestration: ‘We’re adjusting to the realities’ (NBC)

The case for the sequester’s defense cuts (WonkBlog)

McKeon ‘Very Concerned’ About Sequester’s Military Impact (Washington Wire)

TOP 10 US Military Contractors Performance since March 1

Lockheed Martin LMT 5%

Boeing BA 10% 52 week highs

General Dynamic GD 3%

Raytheon RTN 5%

United Technologies UTX 3.40% All time highs

SAIC Inc SAI 5%

L-3 Communications LLL 3%

BAE Systems BA:L N/A

Oshkosh Corp OSK 5.70% Near 52 week highs

McKesson Corp MCK 4.20% All time highs

What's been said:

Discussions found on the web: