My afternoon train reads:

• Record High Close for Dow, Spurred by Fed and Profits (NYT) see also New Dow Highs Usually Spur More Buying (WSJ)

• ‘Lost decade’ not over for 401(k)s, IRAs (MarketWatch)

• FBI joins SEC in computer trading probe (FT.com) see also U.S. state regulators urge Congress to probe high-frequency trading (Reuters)

• The Latest Prediction of The World’s Wrongest Man (New York)

• Buffett Picks His ‘Bear’ for Annual Meeting (DealBook) see also Buffett’s Lament; or, Don’t Let The “Uncle Warren” Stuff Fool You (Jeff Matthews Is Not Making This Up)

• Greenspan Fed’s Biggest Mistake: LTCM Rate Cuts (Macroeconomic Silence)

• Apple nearly called the iPhone the ‘TelePod’, ‘Mobi’, ‘TriPod’ and even ‘iPad’ (Digital Trends) see also Apple’s Reality Distortion Field Relocates to Wall Street (Time)

• U.S. Has 7th Highest Cancer Rate in the World (WebMD)

• The Mystery of Easter Island (World Property Channel)

• 9 Ways Dr. Seuss Was a Secret Bad-Ass (Hollywood)

What are you reading?

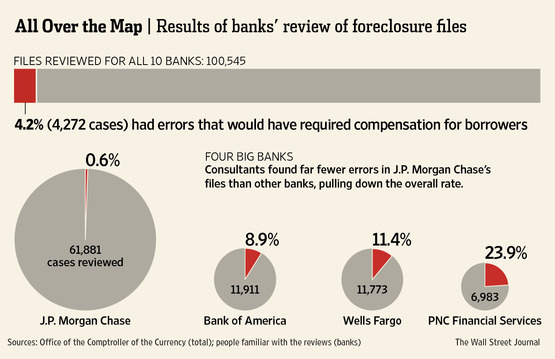

Big Banks Error Rates Raise Questions About $9.3B Settlement

Source: WSJ

What's been said:

Discussions found on the web: