My afternoon train reading:

• Gold Bumps Against Resistance at $1,600 (MarketBeat)

• A Short History of Austerity: It Almost Never Works (The Guardian)

• Yes, Virginia, HFT and Liquidity are Not All They Are Cracked Up to Be (naked capitalism)

• US investors warn on bank settlement (FT.com)

• Wealth, Spending and the Economy (Economix) see also Research ties economic inequality to gap in life expectancy (Washington Post)

• Japan’s Cut for Solar Power Price Retains Boom Incentive (Bloomberg)

• Facebook reveals secrets you haven’t shared (FT.com)

• Eying Apple (The New Yorker)

• Paul Ryan’s make-believe budget (The Washington Post) see also Paul Ryan pretends he didn’t lose (TMB)

• Chief of US Pacific forces calls climate biggest worry (The Boston Globe)

What are you reading?

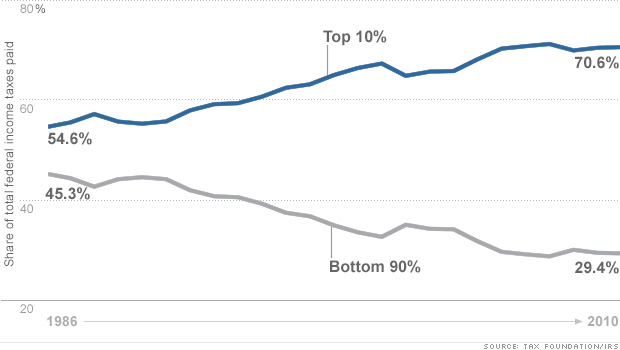

The rich pay majority of U.S. income taxes

Source: CNNMoney

What's been said:

Discussions found on the web: