Some longer form reads to start your weekend off right:

• Wherein Nate Silver Schools SCOTUS Chief Justice Roberts on proper use of statistics (538)

• Life of Pi explained (Great Stories)

• How Disney Bought Lucasfilm—and Its Plans for ‘Star Wars’ (BusinessWeek)

• Whistleblower: Wells Fargo Fabricated and Altered Mortgage Documents on a Mass Basis (naked capitalism)

• How Dollar Diplomacy Spelled Doom for the British Empire (Echoes)

• Lipstick on an Elephant: Deep behind a tangle of denial and rebranding initiatives, a GOP resuscitation plan emerges (New York)

• China’s Richer-Than-Romney Lawmakers Reveal Reform Challenge (Bloomberg)

• Covert Malaysian Campaign Touched A Wide Range Of American Media (BuzzFeed) see also News outlets unearth more Donors Trust recipients (Center for Public Integrity)

• How to Score an Office Wife (GQ)

• Japan Earthquake, 2 Years Later: Before and After (In Focus)

What are you doing this weekend?

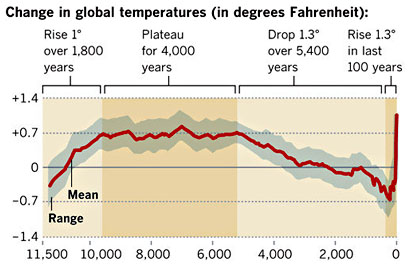

Hockey Stick Graph Now Even More Stickish

Source: Kevin Drum

What's been said:

Discussions found on the web: