Click to enlarge

Source: RecessionAlert

My pal Lakshman Achuthan was just on Bloomberg TV, defending his 2013 (and 2012) recession call.

While I respectfully disagree, I understand his point: The current environment is a typical feeble post-credit crisis recover. Indeed, we are in a Fed driven economy, and but for their interventions, we in the USA would very likely already be in a recession. As I have have stated to many times, but for the Fed, equity markets would likely be 20-30% lower (and I may be too optimistic with those numbers).

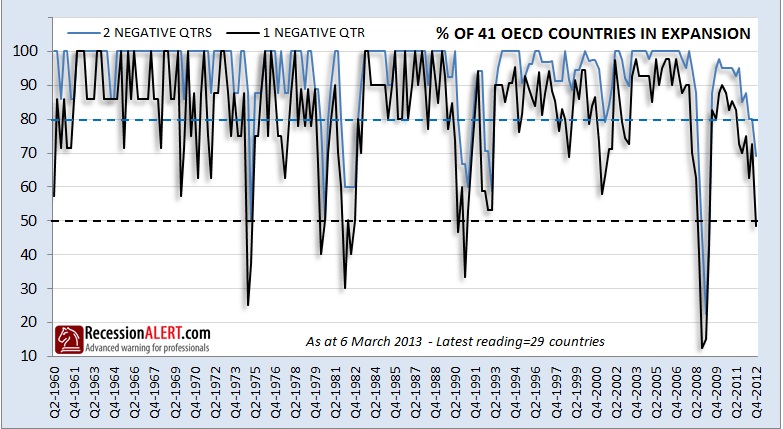

But the key takeaway, based on the chart above from Recession Alert, is that the rest of the world IS ALREADY IN a recession. Indeed, more than half of the 41 OECD member nations are in economic contractions — and have been since Q4 2012.

Here is the bizarre twist: As I will explain in this weekend’s WaPo column, this hardly matters for equities. In fact, markets correct before official recessions, primarily because contractions typically show up in earnings long before they do in the economic data . . .

What's been said:

Discussions found on the web: