My Friday morning reads:

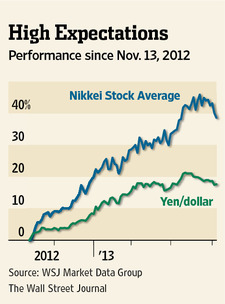

• Abenomics Takes Off: Can Japan Un-Doom Itself? (Atlantic) see also Japanese bank governor Haruhiko Kuroda makes history with monetary blitz (Telegraph)

• Corzine Blasted in MF Global Autopsy (WSJ)

• Brisk pace of rule making slows at CFTC (Financial News) see also ‘Don’t Panic – Financial Reform is Coming’ (Economist’s View)

• Golden Moment Wanes for Investors (WSJ)

• The rise of the bitcoin: Virtual gold or cyber-bubble? (Washington Post) see also Bitcoin Purchasers Should Just Keep Their Dollars Instead (The Daily Beast)

• Breaking Free of the Cellphone Carrier Conspiracy (NYT)

• America’s Most (and Least) Religious Metro Areas (Atlantic Cities)

• Apple widens its lead on Samsung in the US (The Loop) see also Apple has to think different about China (Gigaom)

• Why Facebook Home bothers me: It destroys any notion of privacy (Gigaom)

• 13 Things Roger Ebert Said Better Than Anybody Else (BuzzFeed)

What are you reading?

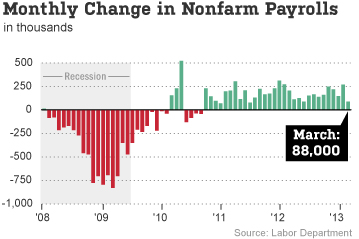

U.S. Economy Adds Just 88,000 Jobs

Source: WSJ

Easing Jolts Japan’s Markets

Source: WSJ

What's been said:

Discussions found on the web: