My morning reads:

• Apocalypse, Not Now, for Municipal Bonds: $573.2 million in Munis defaulted in 2013 (0.6% of the $3.7 trillion outstanding) versus 1.01% for 2013 (Barron’s)

• Investors Should Beware the Dark Side of Defensive Stocks (WSJ) but see Best Six Months Ending, Time to Warm Up Defense (Stock Traders Almanac)

• On the virtuous circle of exporting deflation (FT Alphaville)

• 401k Critiques:

…..-John Bogle: The “Train Wreck” Awaiting American Retirement (PBS)

…..-Index Funds: The Key to Saving for Retirement? (PBS)

…..-Five Moments that Shaped the 401(k) (PBS)

• Most amusing read today: KrugTron the Invincible (Noahpinion)

• The cost of austerity and slow recoveries (Antonio Fatas and Ilian Mihov on the Global Economy) see also Liquidity Trap or Credit Deadlock (Uneasy Money)

• The 2014 iBeetle Is Like an iPhone on Wheels (NYT)

• Gleick: “Total Noise,” Only Louder (New York Mag) see also Lost in Space (NYT)

• Meet the New Enforcement Chief of the SEC – The Guy Who Orchestrated Last Year’s Discredited National Mortgage Settlement on Behalf of Wall Street (Wall Street on Parade)

• Snoop Lion Answers Your Questions (WSJ)

What are you reading?

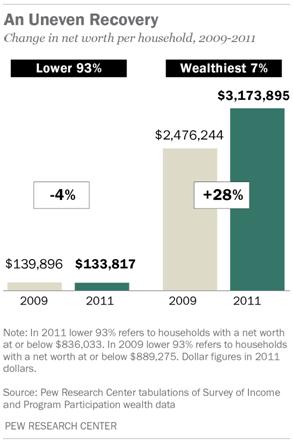

A Rise in Wealth for the Wealthy; Declines for the Lower 93%

Source: Pew Social Trends

What's been said:

Discussions found on the web: