My afternoon train reading:

• Did Apple make the iPhone 4 too good? (MarketWatch) see also Apple’s Bear Case Remains Intact (MoneyBeat)

• A Bullish Magazine Cover Is The Silliest Reason To Sell Stocks (Business Insider)

• Wolf: Austerity loses an article of faith (FT.com)

• 10 investing rules for the coming bond crash (MarketWatch)

• High Frequency Trading and the Hacked Associated Press Twitter Account (Policy Shop) see also Fake Tweet Erasing $136 Billion Shows Markets Need Humans (Bloomberg)

• What BP Doesn’t Want You to Know About the 2010 Gulf Spill (The Daily Beast)

• The Business of Blowing People Up (priceonomics) see also America’s 99-Year War Against Terrorist Bombers (Echoes)

• Bright Minds and Dark Attitudes: Lower Cognitive Ability Predicts Greater Prejudice Through Right-Wing Ideology and Low Intergroup Contact (Sage)

• How the Wheels Came Off for Fisker (WSJ) see also Breaking Down on the Road to Electric Cars (NYT)

• Couch Slouch on the 2013 NBA playoffs (Washington Post)

What are you reading?

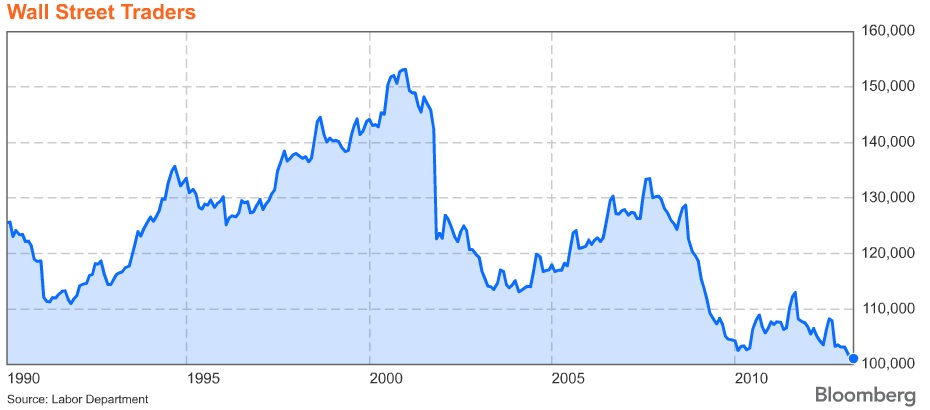

Wall Street Jobs Plunge as Profits Soar

Source: Bloomberg

What's been said:

Discussions found on the web: