My afternoon train reads:

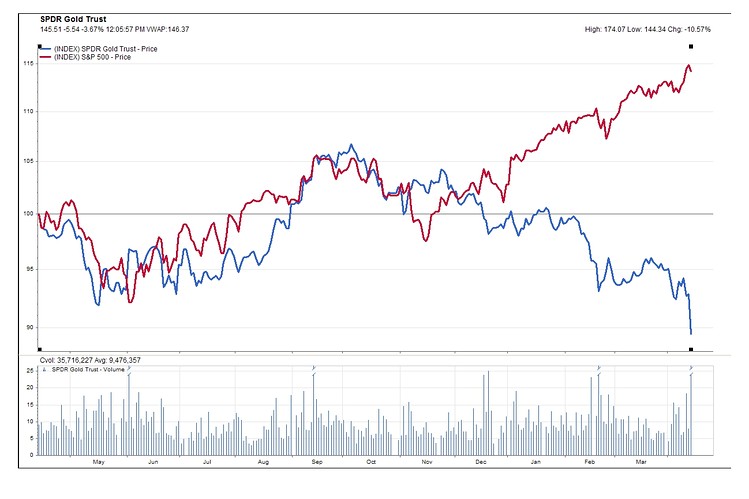

• Gold Futures Sink Most Since 1980 While Stocks Tumble (Bloomberg) see also The Price of Gold Is Crashing. Here’s Why (Businessweek)

• The value of social sentiment (MarketWatch)

• Why E.T.F.’s Won’t Solve Our Behavioral Problems (bucks)

• Value Investing Is Not Dead. (I Heart Wall Street)

• A Brief, Opinionated History of Taxes in America (The Awl) but see 5 charts that will make you feel better about paying your taxes (Wonkblog)

• SCOTUSblog: A totally unsexy, vitally important blog that should be talked about as much as BuzzFeed (pandodaily)

• Who Will Succeed Bernanke? Who Should? (WSJ)

• Bank regulators gain ground against too-big-to-fail bailouts (Reuters) see also Europe’s banks need to be recapitalised – now (FT.com)

• I was a political astroturfer (Salon)

• The spammer who logged into my PC and installed Microsoft Office (ars technica)

What are you reading?

Gold, Stocks No Longer Dancing Together

Source: WSJ

What's been said:

Discussions found on the web: