My morning reads to start your week:

• Here Comes the Next Hot Emerging Market: the U.S. (WSJ)

• The Fundamentals of Market Tops (The Aleph Blog) see also Finding the best four-year market forecaster (MarketWatch)

• Wall Street betting billions on single-family homes in distressed markets (Washington Post)

• Copper Plunges To 18-Month Low– FCX Tumbles With It (ChartWatchers)

• Hedge Fund Gold Wagers Defy Worst Slump in 33 Years (Bloomberg) see also A Technical View for Gold (ChartWatchers)

• Fracking comes to China (CNNMoney)

• Japan Inc. Hesitates to Invest as Yen Spurs Nikkei Rally (Bloomberg)

• How much of Reinhart/Rogoff has survived? (FT.com)

• Why is a commissioner on the Securities and Exchange Commission giving broad investing advice? (Self-Evident)

• This Is the Modern Manhunt: The FBI, the Hive Mind and the Boston Bombers (Wired)

What are you reading?

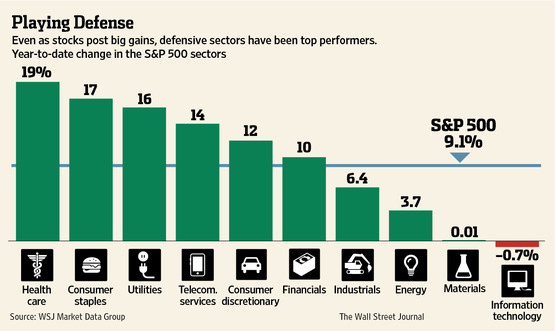

Stock Rally Strikes a Defensive Tone

Source: WSJ

What's been said:

Discussions found on the web: