Good Sunday morning, here are some interesting reads to start off the last day of your weekend:

• Josh Brown: My Investing Edge and the Crossroads (TRB)

• Stock Analysts Tell All: Asked who was their most important group of clients, 81.5% of analysts picked “hedge funds.” Only 13.3% chose “retail brokerage clients.” (WSJ/Total Return)

• Sherrod Brown Takes On Megabanks — and The Obama Administration (Talking Points Memo) see also Trying to Slam the Bailout Door (NYT)

• How to invest? Americans don’t know some basics. (Christian Science Monitor)

• Taibbi: While Wronged Homeowners Got $300 Apiece in Foreclosure Settlement, Consultants Who Helped Protect Banks Got $2 Billion (Rolling Stone) see also Error claims cast doubt on Bank of America foreclosures in Bay Area (Center for Investigative Reporting)

• Welcome to Drug R&D’s Golden Age (Barron’s)

• The Math on Solar is about to Change our World (Monetary Realism)

• Psychopaths’ Brains Aren’t Wired To Show Empathy, Study Finds (HuffPo)

• Hey look, a dishonest whitepaper (Lepinkski) see also The One Where Dell Admits It Doesn’t Know Anything About The Post-PC era (Chambers Daily)

• Surprisingly interesting & unusual sports story: Ankiel a rare player reinvented (NBC Sports)

What’s for brunch this morning?

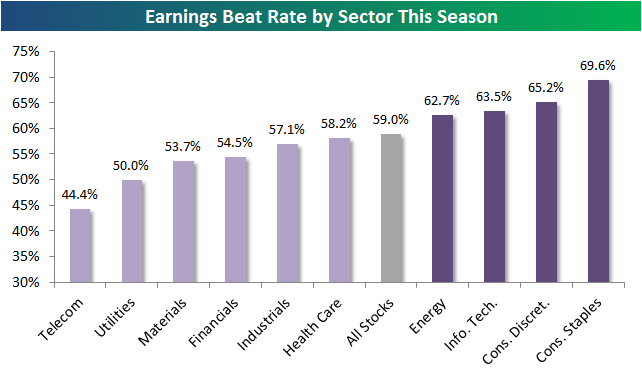

Earnings Beat Rate by Sector

Source: Bespoke

What's been said:

Discussions found on the web: