My afternoon train reading:

• Mom and pop: The world’s worst investors (MarketWatch)

• China Turns Graveyard From Goldmine Hurting Ship Makers: Freight (Bloomberg)

• The Growing Sentiment on the Hill For Ending ‘Too Big To Fail’ (Rolling Stone) see also Big Banks’ Success Could Spell Their Doom (Bloomberg)

• Fiduciary Duty to Cheat? Stock Market Super-Star Jim Chanos Reveals the Perverse New Mindset of Financial Fraudsters (AlterNet)

• A Debate in the Open on the Fed (NYT) see also Helicopter QE will never be reversed (Telegraph)

• The NRA’s disarming plan to arm schools (Washington Post)

• Keystone XL: The pipeline to disaster (Los Angeles Times)

• David Stockman and the Cult of Gloom (Atlantic)

• Twenty Awesome Covers From The US Space Program (Space)

• The Lease They Can Do: What the Fight Over ‘Used’ Music Reveals About Online Media (Businessweek)

What are you reading?

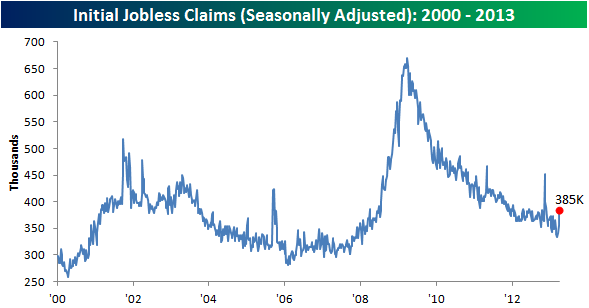

Initial Jobless Claims Rise More Than Expected

Source: Bespoke

What's been said:

Discussions found on the web: