My morning reads:

• Growls Keep Coming From the Bear’s Den (WSJ)

• Dividends Continue to Rise (Crossing Wall Street)

• Raw-Material Bull Market Fading as Supply Expands: Commodities (Bloomberg)

• Why It’s Still Hard to Get a Mortgage (Real Time Economics)

• The April Fool’s economy (Wonkblog) see also Investors Ignore Negativity at Their Peril (WSJ)

• How to Win the Bloodthirsty Battle for Tech Talent (Fast Company)

• Poll Finds Banks Are Too Big, Most Americans Say (Huffington Post)

• The simple, boring reason why disability insurance has exploded (Wonkblog)

• How Memes Are Orchestrated by the Man (Atlantic)

• Green Meteorite May Be from Mercury, a First (Space)

What are you reading?

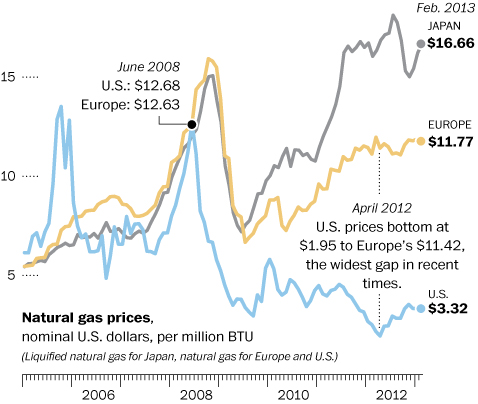

European industry flocks to U.S. to take advantage of cheaper gas

Source: Washington Post

What's been said:

Discussions found on the web: