My afternoon train reading:

• Gold was trounced in massive selloffs in 1915-20, 1941, 1947, 1951-66, 1974-76 1981, 1983-85, 1987-2000 and 2008. (MarketWatch)

• Goldman’s big think about the commodity sell-off (FT Alphaville)

• How America Can Beat Deflation, NYC Style (The Reformed Broker)

• The Central Bank Dog Ate My Homework (Investing Caffeine)

• A few comments on Housing Starts (Calculated Risk)

• Senator Pushes for Investigation of ‘False Statements’ by Dark Money Groups (propublica) see also Financial crisis caused by too many bankers taking cocaine, says former drugs tsar (Telegraph)

• Why Thatcher Wasn’t Her Era’s Most Transformative Leader (Echoes)

• Windows: It’s over (ZDNet)

• Summer Ice Melt In Antarctica Is At The Highest Point In 1,000 Years, Researchers Say (HuffPo)

• The Truth About Google Fiber (PC Mag)

What are you reading?

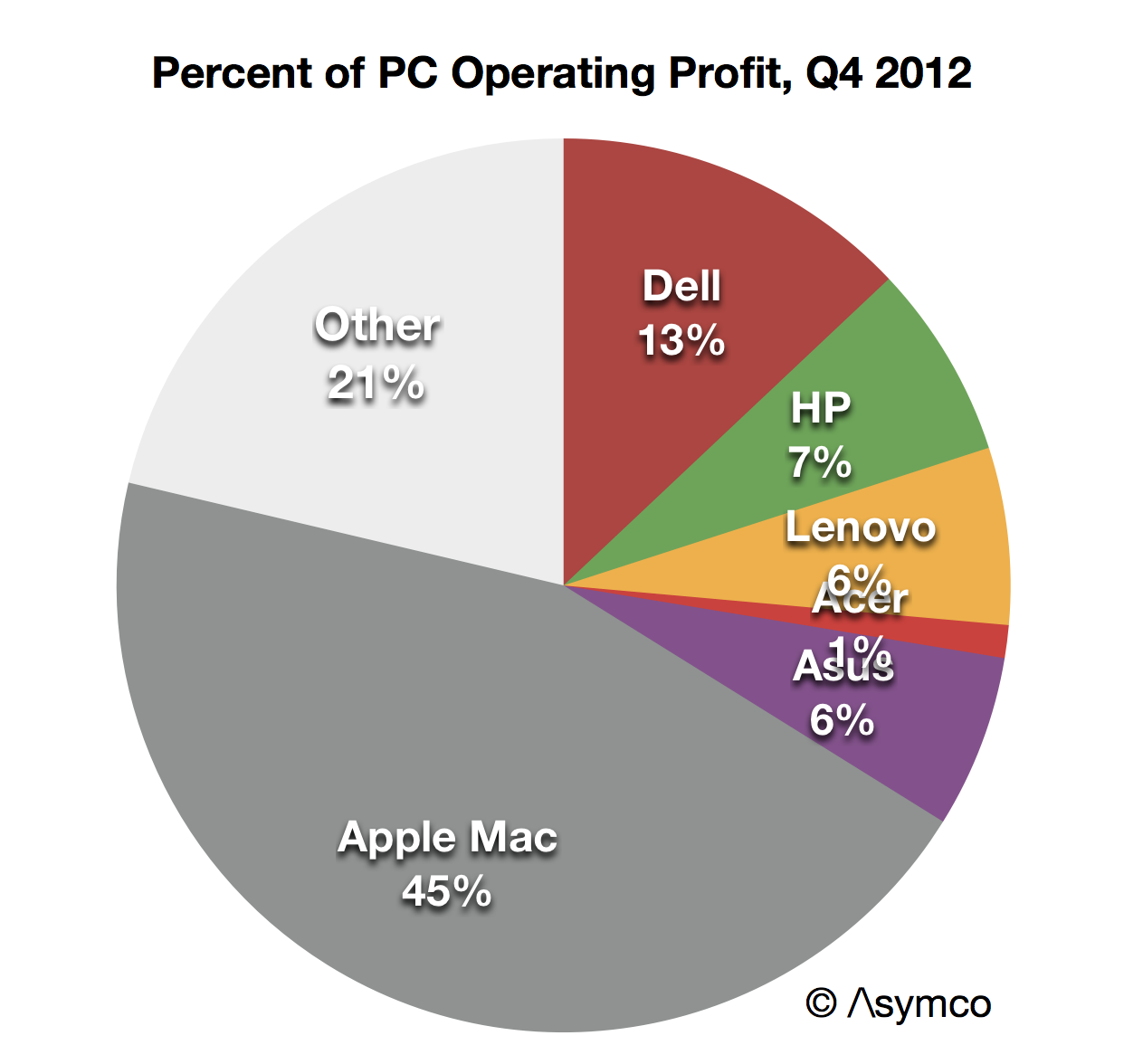

The Surprising Breakdown of profits in the PC Space

Source: Asymco

What's been said:

Discussions found on the web: