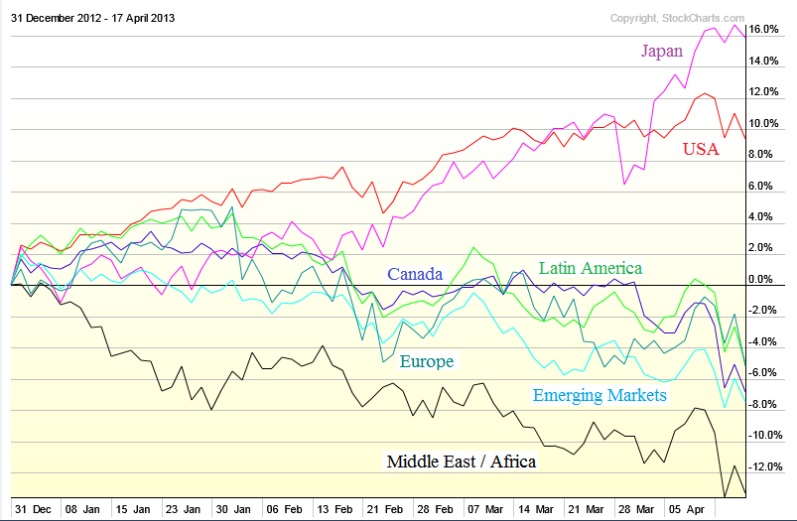

A Year-To-Date Look At The World

Click to enlarge

Source: All Star Charts

The chart above, from JC, shows how the world has been doing since the start of the year.

I can only think of three possible future outcomes, from best to worst:

1. Rally! The rest of the world bottoms, reverses, then gets pulled higher by the US and Japan. China and India resume their torrid growth.

2. Meh! The US & Japan soften a little, the rest of the world improves a bit, we muddle through.

3. Look out Below! The rest of the world drags US & Japan down.

These divergences tend to not last very long . . .

What's been said:

Discussions found on the web: