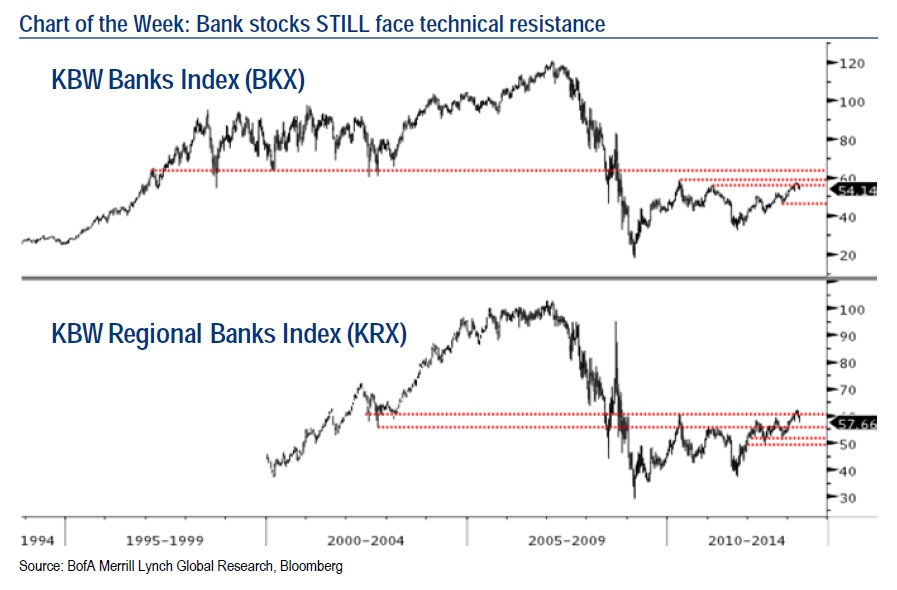

Stephen Suttmeier of Merrill Lynch writes:

“Given the recent pullback in bank stocks (2.5% down since reporting season started), we decided to take a look at how the bank indices stack up from a technical standpoint, given few fundamental catalysts that we see near term. Both the banks and the broader financials sector continue to test the major or secular resistance at prior lows from 2002, 2003, 2000 and 1998 – which is proving to be an important barrier so far in 2013. This resistance is 230-270 on the S&P 500.

Financials (at 243 currently) and 54-65 on the BKX (at 55 currently). The KRX (currently at 59) briefly pushed above resistance at the prior lows from 2002-2003 at 56-61, but has since pulled back and has not sustained the move higher. The S&P 500 Financials Index & KRX both achieved new recovery highs in the cyclical bull market from March 2009, but the BKX has not confirmed this move & is below its April 2010 recovery high of 58-59.

The lack of a new recovery high in the BKX is a negative divergence for the sector.”

I have been biased against the major money center banks ever since the financial collapse; my problem with the banks has been their opaque earnings reporting and off-balance sheet liabilities. The technicals are simply another reason to be wary

Source:

Will bank stocks continue to grind lower?

Erika Penala, Stephen Suttmeier, Ebrahim H. Poonawala, Katherine Lin, Kevin Senet

Merrill Lynch April 21, 2013

What's been said:

Discussions found on the web: