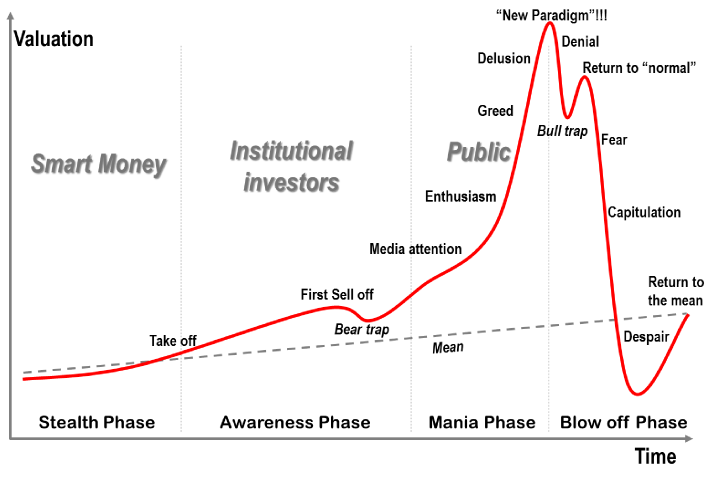

Bubbles and Manias

Source: Jean-Paul Rodrigue, Dept. of Global Studies & Geography, Hofstra University

Fascinating chart showing the psychological of a longer market cycle via Prof Jean-Paul Rodrigue.

Previously:

Lagging Psychology at Turning Points

Investor Sentiment Wheel

Psy Cycle

Economic Cycles and Investing

What's been said:

Discussions found on the web: