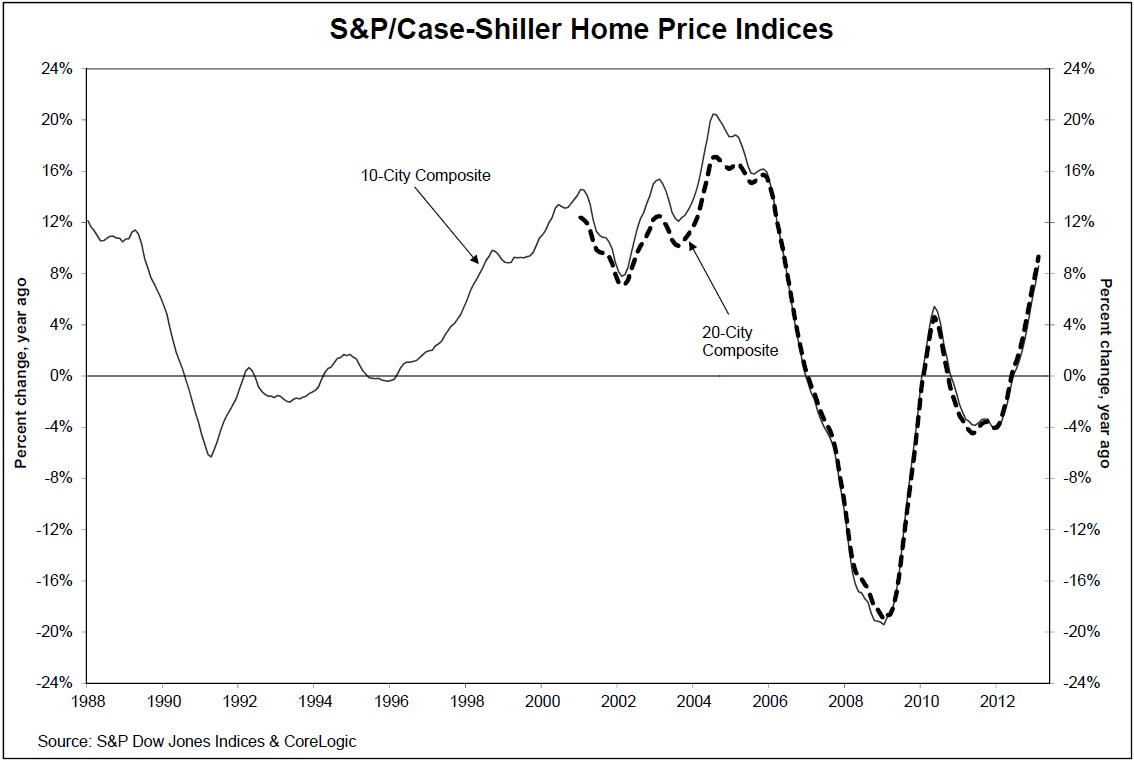

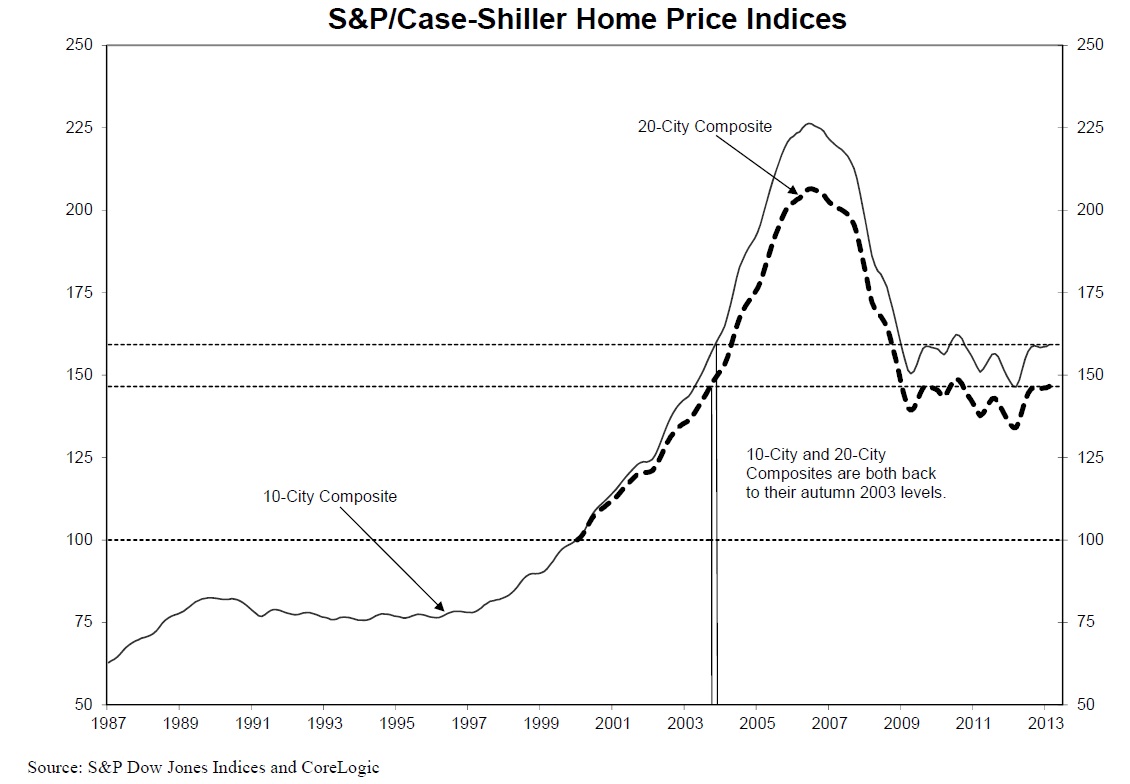

Data through February 2013 showed average home prices increased 8.6% and 9.3% for the 10- and 20-City Composites in the 12 months ending in February 2013.

For data junkies, you can access more than 26 years of history for these series in full by going to

homeprice.spindices.com. Additional content on the housing market may also be found on S&P Dow Jones Indices’ housing blog: housingviews.com.

S&P/Case-Shiller Home Price Indices

What's been said:

Discussions found on the web: