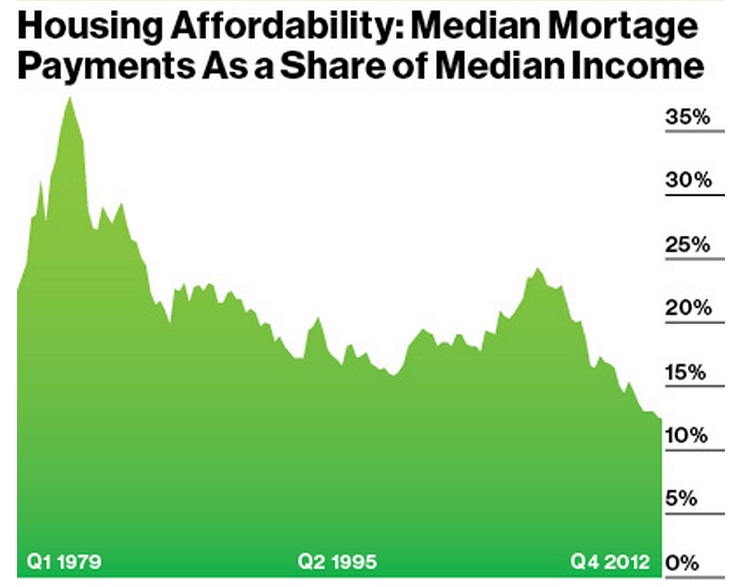

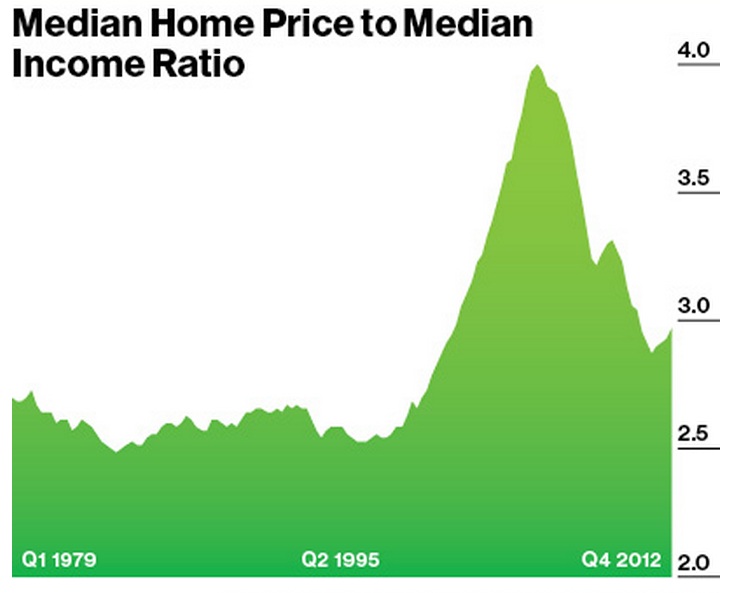

“We are currently in a carnival funhouse mirror. Homes seem quite affordable when at base they are not.”

-Stan Humphries, chief economist at Zillow.

Nice piece in Business Week explaining how ultra low mortgage rates are creating a misleading sense of the housing market . . .

Source:

Cheap Mortgages Are Hiding the Truth About Home Prices

Karen Weise

Businessweek, April 10, 2013

http://www.businessweek.com/articles/2013-04-10/cheap-mortgages-are-hiding-the-truth-about-home-prices

What's been said:

Discussions found on the web: