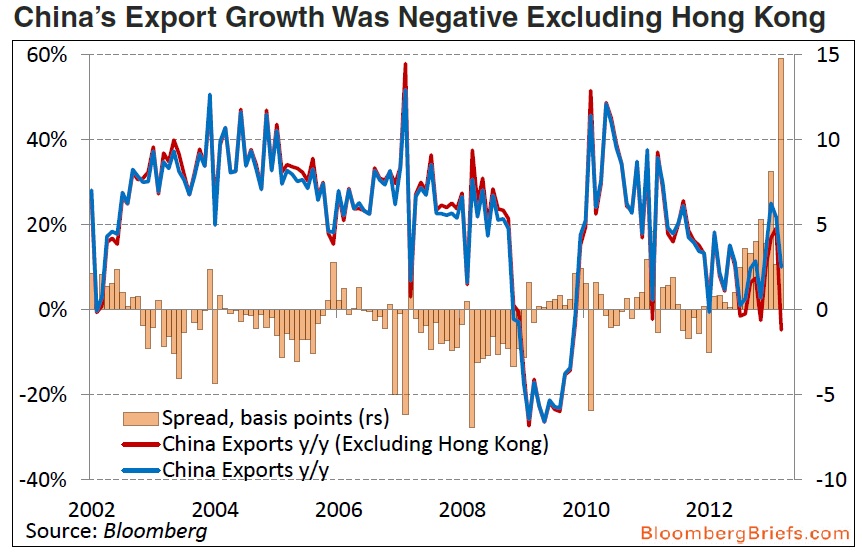

China’s external sector is probably expanding much more slowly than overall export growth implies.Have a look at “unusual surges” in China’s “reported shipments to Hong Kong.” It seems the entire country is either channel stuffing or dumping goods or ever cooking books via inflated invoices. Another thesis is that Exporters are “repatriating capital through export transactions rather than through traditional methods” to avoid Mainland’s controls and/or taxes.

In other words, China’s exports as well as growth prospects have been somewhat exaggerated.

Here is Bloomberg Brief:

“While global export demand from other Asian countries has been tepid, Chinese trade has defied gravity, showing substantial growth in the past several months.

Chinese exports to Hong Kong jumped 93 percent year-on-year in March, while annual growth has averaged more than 50 percent since September. Hong Kong now accounts for 27 percent of China’s total monthly ex-ports, compared with less than 16 percent prior to September. None of China’s other major trading partners saw growth of this magnitude.

Export growth in March to most developed countries, including Germany, Japan, the U.S., France and Australia, was at least one standard deviation below each country’s 12-year average. China’s overall exports rose 10 percent year-on-year in March. Excluding Hong Kong, that would have been a 4.8 percent contraction.”

China can potentially see its economy slow even faster if these exports are being artificially goosed by accounting sleight of hand.

Its simply another improbable data point in the closed system of centrally planned pseudo-capitalism.

Source:

China Trade Anomalies May Imply Slower Growth

Michael McDonough

Bloomberg Brief, April 23, 2013

What's been said:

Discussions found on the web: